Inflation: please explain

Moderator: Moderators

The source for that graph, http://www.zerohedge.com/(as far as I can tell, it is hosted there and a google for gold rate for today doesn't pop up a site), is not selling gold. And the reason chances are you are not that guy is because most people listen to the moronic financial advisors who didn't see just about every major financial event coming. When somebody tells you to buy gold you should be very skeptical, because chances are they just bought gold and want to see that gold become worth more money in the future.

Again:Vnonymous wrote:Under that definition investing in ANYTHING is a gamble.

Gold is a fucking gamble. This has been demonstrated numerous times in this thread. You get lucky with selling high after buying low. If you weren't lucky, you're almost certainly a fucking criminal who engaged in some sort of securities fraud. Like insider trading.

It is not an investment.

And no matter how much you cry and whine like a baby, it is not an investment. Even if you bring up the dictionary definition of investment, gold does not fit that definition.*

People are not arguing that investments == gamble. People are saying that you are a moron for thinking that gold is an investment when it is most demonstrably a gamble.

So stop peddling stupid get-rich-quick schemes you know nothing about.

* The biggest reason why gold doesn't fit the definition of "investment"? Because an investment is an asset, meaning that it is capable of generating wealth on its own. Say you setup a business for $1M. It earns $10K a month. That's an asset.

Gold by contrast does not earn money. It may increase in paper value because people are idiots (and market speculators keep pumping up the price), but it does not actually produce anything of value. It just sits in vaults doing fucking nothing.

Last edited by Zinegata on Mon May 02, 2011 11:19 am, edited 2 times in total.

http://en.wikipedia.org/wiki/Gold_as_an_investmentZinegata wrote: Again:

Gold is a fucking gamble. This has been demonstrated numerous times in this thread. You get lucky with selling high after buying low. If you weren't lucky, you're almost certainly a fucking criminal who engaged in some sort of securities fraud. Like insider trading.

It is not an investment.

And no matter how much you cry and whine like a baby, it is not an investment. Even if you bring up the dictionary definition of investment, gold does not fit that definition.*

Well gee I guess me, wikipedia and the entire financial industry have just been hallucinating this entire time! That's why you never see the price of gold on the evening news, and it is talked about in the same breath as the horse races or the pokie machines. Nobody ever monitors or tracks the price of gold, and nobody makes serious money out of providing or buying it! After all, it is just a gamble.

You can whine and whinge all you want about how gold isn't an investment because it isn't an asset and blah blah blah and then go out and look like an idiot the moment you open your mouth in a serious discussion of financial issues. Gold is seen as an investment by the entire financial industry and is one under the most commonly accepted definition of investment.

- Ancient History

- Serious Badass

- Posts: 12708

- Joined: Wed Aug 18, 2010 12:57 pm

The reason gold is an investment is because people have decided it is an investment. Just like non-industrial diamonds, non-industrial gold is all about perceived value, not actual value, and the market is driven by a bunch of yahoos selling gold at inflated prices by convincing idiots to pay those prices. If you have gold, the only thing you can do with it is try to find a bigger idiot to buy it off you...if gold was such a great investment, people wouldn't be so bloody eager to sell it.

-

Username17

- Serious Badass

- Posts: 29894

- Joined: Fri Mar 07, 2008 7:54 pm

Gold is not an "investment" in the way that we use the term for other financial undertakings. To illustrate the difference, let's consider cows. Cows are a commodity, and they can be bought and sold. And people can invest in cows, and they can gamble on cows.

Here's how investing in cows works: you buy some cows. Then you let them eat grass and get bigger and maybe make more cows, and later on you have more mass worth of cow (possibly distributed between more total cows), and sell it off either in pieces or all at once and the thing you invested in is literally more commodity now than when you bought it and you can make money on this even if the vagaries of the marketplace reduce the price of cow in the meantime.

Now here's how gambling on cows works: you buy the rights to some amount of cow, and later on you sell it again when the price of cow rises or you need the money to keep the company from turning the power off in your building. Or you take the other end of a shorting contract and simply agree to be paid the amount that X amount of Cow costs on Thursday in exchange for paying out whatever the same amount of Cow would have cost on Tuesday. You make money if you guess correctly that the price of cow will rise in the interim more than transaction costs, and you lose money if you guess wrong.

The point is that with gold, the only possible action is of the second type. The only reason that it's called "investing in gold" is because gold bugs have gotten together and insist on calling it that. If it were any other commodity, that would be called "speculating on gold" or perhaps "betting on gold".

-Username17

Here's how investing in cows works: you buy some cows. Then you let them eat grass and get bigger and maybe make more cows, and later on you have more mass worth of cow (possibly distributed between more total cows), and sell it off either in pieces or all at once and the thing you invested in is literally more commodity now than when you bought it and you can make money on this even if the vagaries of the marketplace reduce the price of cow in the meantime.

Now here's how gambling on cows works: you buy the rights to some amount of cow, and later on you sell it again when the price of cow rises or you need the money to keep the company from turning the power off in your building. Or you take the other end of a shorting contract and simply agree to be paid the amount that X amount of Cow costs on Thursday in exchange for paying out whatever the same amount of Cow would have cost on Tuesday. You make money if you guess correctly that the price of cow will rise in the interim more than transaction costs, and you lose money if you guess wrong.

The point is that with gold, the only possible action is of the second type. The only reason that it's called "investing in gold" is because gold bugs have gotten together and insist on calling it that. If it were any other commodity, that would be called "speculating on gold" or perhaps "betting on gold".

-Username17

This is starting to get silly. Gold is both an investment and a gamble. It is an "investment" in that it is a comodity that often goes against the grain of other investments. In order to really work the "buy low / sell high" mantra (there is another name for this strategy - asset allocation) you need to find an investment that is low when the other is high, so you are always pushing off the stuff that is on their high cycles to the stuff that is on their low cycles. In a balanced portfolio there is a logical place for gold or silver. Heck, it's still a vast level above penny stocks no matter how bad the precious metals market gets.

On the other hand: Gold Price Falls to $1,550 as Silver Crashes

On the other hand: Gold Price Falls to $1,550 as Silver Crashes

Everything can bubble, houses, tech stocks, even gold and silver.GOLD PRICE NEWS – The gold price declined $11.50 to $1,552 per ounce Monday morning after sinking as low as $1,541 per ounce late last night. The price of gold fell following a sudden plunge in silver, which fell nearly 11% overnight to $42.68 per ounce before stabilizing near $45.00 early this morning. Silver fell on the back of the CME Group’s decision to raise margin requirements yet again and on worries that a bubble was developing in gold’s sister precious metal. Silver has gained 81% over the past three months, compared to an 18% rise in the gold price over the same time frame.

I love it...silver falls to where it was a few weeks ago, and that's a 'crash'.

There are quite a few charts showing that gold isn't in a bubble (at least, as the word is normally defined, the massive confusion over 'investment' and 'gamble' doesn't motivate me to try to explain further).

Gold and silver will certainly bubble eventually...but the talking heads said gold was in a bubble at 600...and at 700...at 800...and at 900...and at 1000...and at 1100...and at 1200...and at 1300...and at 1400...I'm sure they'll be right at some point, although whether the dollar will have a meaningful value at that point is questionable.

Anyway, just because cows offer conservate and speculative investment opportunities doesn't mean it's not a gamble either way.

When you buy those cows conservatively, you're gambling that the cows don't all get a disease, that you won't get licensed/regulated out of existence, that drought won't make having a herd impossible...all sorts of risks, mitigated, sometimes, by the possible (theoretical) infinite profits. When you buy 'cow options' of the second type, you're just gambling in a more aggressive, riskier way.

Similarly, you can buy actual gold (conservative), or you can buy gold options (speculative). Just because the former has a hard cap on potential profits (i.e., 'infinite profits' is fundamentally impossible) doesn't make it a non-investment, just makes it, often, a bad investment.

The fact that infinite profits are empirically impossible in the conservative form of investment, either way (never happened in the history of the world, although Bill Gates has come closest for investing in his company), means calling one a gamble and the other an 'investment' is splitting hairs.

Either way, it's also impossible to make infinite profits on options buying...but you do get your profits quicker if there are any.

"Investment" is just a $10 word that means "gamble".

Back to gold, current (the last 10 years) market conditions have just made it a good investment for now, is all. Historically, still a bad investment, but an intelligent investor doesn't really care about how things were 1,000 years ago (back when having lots of wooden ships was good), or 100 years ago (back when player pianos and typewriters were the cat's meow)...what matters to an intelligent investor is 'now', and little is different now than in the past decade.

There are quite a few charts showing that gold isn't in a bubble (at least, as the word is normally defined, the massive confusion over 'investment' and 'gamble' doesn't motivate me to try to explain further).

Gold and silver will certainly bubble eventually...but the talking heads said gold was in a bubble at 600...and at 700...at 800...and at 900...and at 1000...and at 1100...and at 1200...and at 1300...and at 1400...I'm sure they'll be right at some point, although whether the dollar will have a meaningful value at that point is questionable.

Jeesuz, Frank, another conspiracy theory?The only reason that it's called "investing in gold" is because gold bugs have gotten together and insist on calling it that.

Anyway, just because cows offer conservate and speculative investment opportunities doesn't mean it's not a gamble either way.

When you buy those cows conservatively, you're gambling that the cows don't all get a disease, that you won't get licensed/regulated out of existence, that drought won't make having a herd impossible...all sorts of risks, mitigated, sometimes, by the possible (theoretical) infinite profits. When you buy 'cow options' of the second type, you're just gambling in a more aggressive, riskier way.

Similarly, you can buy actual gold (conservative), or you can buy gold options (speculative). Just because the former has a hard cap on potential profits (i.e., 'infinite profits' is fundamentally impossible) doesn't make it a non-investment, just makes it, often, a bad investment.

The fact that infinite profits are empirically impossible in the conservative form of investment, either way (never happened in the history of the world, although Bill Gates has come closest for investing in his company), means calling one a gamble and the other an 'investment' is splitting hairs.

Either way, it's also impossible to make infinite profits on options buying...but you do get your profits quicker if there are any.

"Investment" is just a $10 word that means "gamble".

Back to gold, current (the last 10 years) market conditions have just made it a good investment for now, is all. Historically, still a bad investment, but an intelligent investor doesn't really care about how things were 1,000 years ago (back when having lots of wooden ships was good), or 100 years ago (back when player pianos and typewriters were the cat's meow)...what matters to an intelligent investor is 'now', and little is different now than in the past decade.

Last edited by Doom on Mon May 02, 2011 11:00 pm, edited 4 times in total.

-

DSMatticus

- King

- Posts: 5271

- Joined: Thu Apr 14, 2011 5:32 am

Doom, wait. You think the government is hiding an economically apocalyptic inflation rate, but you don't think financial brokers will call gold an investment to make it sound respectable? You think the government is lying to you, but you trust bankers and advertisements? But that aside, whether or not gold is an investment is 'semantics.' Whether you want to call it investment or not, there IS a clear difference between the two sorts of things we're talking about.

The first is the idea of investing in capital, with the expectation that that capital will produce more capital or different capital. (Cows make more cows, meat, or milk. You have more capital than you did before. Is investment gambling? Yes.)

The second is the idea of commodity speculation (you can call this investing in commodities, but that's a nice name for something so incredibly hideous), where you buy a commodity, either physically or on paper, and then sit on it until it grows in value. Then it appreciates in value and you sell it. (Is this gambling? Usually even more so, because there's no production of value.)

Again, this argument is semantical. We're talking about two clearly distinct concepts, some of us don't think B falls under the investment category, some do. Who gives a shit? It's barely above debating grammar. It does, however, remain very, very clear that commodity speculation is different than investing in capital, and this is the point people are trying to stress.

Now, as for the matter of gold speculation... Gold speculation is a horrible fucking idea. Gold has an over-inflated value, based on history, gullibility, and the amount of money pumping into the gold market. Apparently, a lot of people are convinced that when the apocalypse comes (or the economy collapses, whatever these nutjobs believe will happen), gold's value will magically stick while the dollar plummets. Or maybe they think they can eat it. I don't know.

But that aside, you really can make money on gold (and commodity speculation in general). How? By cashing out after everyone stops buying, but before anyone starts selling. It's that simple. What happens in those cases? Well, to put it succintly - you reach into the pockets of everyone who still has gold, whisper "you're a dumbass" in their ear, and take some money out of their wallet. Meanwhile, the broker has taken his cut (both ways) out of each of your wallets. And really, there are big, big banks who can invest in gold better than you do, because they have real-time access to every little trend or statistical blip, and they know exactly when that market is going to flip because their customers are the ones deciding when it flips, and they are watching their customers. So they will probably short all of you even more than you are shorting eachother. Or maybe they're happy just taking their cut while you rip off eachother.

But either way, it should be immediately obvious that this sort of speculation is horrible for the economy. It's an investment in the same way investing in a set of burglar's tools is an investment - the only thing you're doing is hoping you'll be able to steal someone else's shit, and you're spending money and dedicating a substantial part of your economy to doing so. You're making money by creating nothing of value, you're just taking it from people who are. It makes an economy weaker, not stronger.

The first is the idea of investing in capital, with the expectation that that capital will produce more capital or different capital. (Cows make more cows, meat, or milk. You have more capital than you did before. Is investment gambling? Yes.)

The second is the idea of commodity speculation (you can call this investing in commodities, but that's a nice name for something so incredibly hideous), where you buy a commodity, either physically or on paper, and then sit on it until it grows in value. Then it appreciates in value and you sell it. (Is this gambling? Usually even more so, because there's no production of value.)

Again, this argument is semantical. We're talking about two clearly distinct concepts, some of us don't think B falls under the investment category, some do. Who gives a shit? It's barely above debating grammar. It does, however, remain very, very clear that commodity speculation is different than investing in capital, and this is the point people are trying to stress.

Now, as for the matter of gold speculation... Gold speculation is a horrible fucking idea. Gold has an over-inflated value, based on history, gullibility, and the amount of money pumping into the gold market. Apparently, a lot of people are convinced that when the apocalypse comes (or the economy collapses, whatever these nutjobs believe will happen), gold's value will magically stick while the dollar plummets. Or maybe they think they can eat it. I don't know.

But that aside, you really can make money on gold (and commodity speculation in general). How? By cashing out after everyone stops buying, but before anyone starts selling. It's that simple. What happens in those cases? Well, to put it succintly - you reach into the pockets of everyone who still has gold, whisper "you're a dumbass" in their ear, and take some money out of their wallet. Meanwhile, the broker has taken his cut (both ways) out of each of your wallets. And really, there are big, big banks who can invest in gold better than you do, because they have real-time access to every little trend or statistical blip, and they know exactly when that market is going to flip because their customers are the ones deciding when it flips, and they are watching their customers. So they will probably short all of you even more than you are shorting eachother. Or maybe they're happy just taking their cut while you rip off eachother.

But either way, it should be immediately obvious that this sort of speculation is horrible for the economy. It's an investment in the same way investing in a set of burglar's tools is an investment - the only thing you're doing is hoping you'll be able to steal someone else's shit, and you're spending money and dedicating a substantial part of your economy to doing so. You're making money by creating nothing of value, you're just taking it from people who are. It makes an economy weaker, not stronger.

Uh, DSMatticus, you think having sex with 8 year old boys is fun, and you're posting here?DSMatticus wrote:Doom, wait. You think the government is hiding an economically apocalyptic inflation rate,

In other words, try not putting words in my mouth, please.

By the way, another pack of liars also says BLS is wrong. But MIT folks are just morons, I guess.

Sure, one's a gamble, anothers a bigger gamble. Kinda like betting on Red in roulette, as opposed to betting on #23. You want to call the former an investment, and the latter a gamble, you go right ahead, but it is just a question of semantics..' Whether you want to call it investment or not, there IS a clear difference between the two sorts of things we're talking about.

You can talk about 'creating capital', but that's little different than just letting your winning bet ride for another spin, and another, and another. Either you're wiped out, or you take your profits.

Everything rises and falls, the key is knowing when to get in, and when to get out.

Suppose you bought stock in a typewriter company in 1900...that's an investment, right? If you kept stock for the last 111 years, you've made infinite capital, right? Nope, almost all typewriter companies are wiped out, now. Now, if you pulled that 'capital' out 40 years ago, and 'invested' in something else, it looks good. But a gamble really is a gamble, honest.

Certainly, theoretically possible. Also possible to have less capital than before.The first is the idea of investing in capital, with the expectation that that capital will produce more capital or different capital. (Cows make more cows, meat, or milk. You have more capital than you did before. Is investment gambling? Yes.)

Even more so, you say yourself. So, you agree.(Is this gambling? Usually even more so, because there's no production of value.)

Been 10 straight years of people saying that, and it's completely insane to say it. Gold's value is its value, nothing more. Gold is money, according to former Alan Greenspan...do you think the head of the US treasury is clueless, too?. Gold has an over-inflated value, based on history, gullibility, and the amount of money pumping into the gold market.

Rofl, I don't think people can eat dollars, but you and others sure think so.Apparently, a lot of people are convinced that when the apocalypse comes (or the economy collapses, whatever these nutjobs believe will happen), gold's value will magically stick while the dollar plummets. Or maybe they think they can eat it. I don't know.

Oh, wow. No other response works.But that aside, you really can make money on gold (and commodity speculation in general). How? By cashing out ...happy just taking their cut while you rip off eachother.

It's queer how folks can say "gold is worthless and meaningless" on one hand, and "it's horrible for the economy" on the other, and see no disconnect. It's usually the same ones who think buying gold is the same thing as eating gold.But either way, it should be immediately obvious that this sort of speculation is horrible for the economy.

Last edited by Doom on Tue May 03, 2011 1:32 am, edited 1 time in total.

Alternatively, we don't think the economy will collapse, so we see no reason to invest in monies "that will still be good after the apocalypse" and we generally frown on speculative guessing in place of investment for various reasons.Doom wrote:Rofl, I don't think people can eat dollars, but you and others sure think so.

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

Gold may be in a bubble, it may not be. If gold was a perfect store of wealth like the adds say then its price should track with inflation. Lets pick an optimistic year, say 1990, the Berlin wall had fell and the 1st gulf war hadn't happened yet. An ounce of gold in 1990 cost around $380[1], using the US government's inflation numbers we'd get a price of $659[2]. If Shadowstats is correct then we can expect gold to go even higher, around $2000[3]* in 2011 dollars. This assumes the increase in gold's price is mostly due to inflation and not demand for jewelry, electronics, dental crowns or whatever. Gold is currently around $1540 an ounce, so it's much closer to the Shadowstats estimate than the BLS's.

It will be interesting to see how gold performs now that OBL has been killed, I've always had the feeling that people turn to gold when they are afraid and with the big boogey man dead people should be feeling safer. If nothing overly dramatic happens in world history over the next few years I can see gold holding steady around $1500-$1600 for the next few years (people may be reluctant to sell for less than what they bough it for). I'm curious to hear other people's predictions and how they arrive at them.

[1] http://www.usagold.com/reference/prices/1990.html

[2] http://www.usinflationcalculator.com/

[3] http://www.shadowstats.com

* Shadowstats shows its estimate to be larger than the BLS's in nominal in a ratio of 80:26, unfortunately they don't give an exact value so this is just a best guess.[/url]

It will be interesting to see how gold performs now that OBL has been killed, I've always had the feeling that people turn to gold when they are afraid and with the big boogey man dead people should be feeling safer. If nothing overly dramatic happens in world history over the next few years I can see gold holding steady around $1500-$1600 for the next few years (people may be reluctant to sell for less than what they bough it for). I'm curious to hear other people's predictions and how they arrive at them.

[1] http://www.usagold.com/reference/prices/1990.html

[2] http://www.usinflationcalculator.com/

[3] http://www.shadowstats.com

* Shadowstats shows its estimate to be larger than the BLS's in nominal in a ratio of 80:26, unfortunately they don't give an exact value so this is just a best guess.[/url]

Oh thank God, finally a thread about how Fighters in D&D suck. This was a long time coming. - Schwarzkopf

I realize that marketing can make anything seem either beautiful or ugly, and you are doing your best to make it "ugly" but you have basically described a significant portion of the entire equities market. Many shares of equity stock do not give "dividends." Then where is the "profit?" The same as the comodity. You hold it under the assumption that over time more people will want it; thus resulting in an increase of the price. You may be surprized at how many major stocks do not have dividends. A significant number have very low dividends; relying on the notion that the value of the stock will advance over time to keep the stockholders happy.DSMatticus wrote:The second is the idea of commodity speculation (you can call this investing in commodities, but that's a nice name for something so incredibly hideous), where you buy a commodity, either physically or on paper, and then sit on it until it grows in value. Then it appreciates in value and you sell it. (Is this gambling? Usually even more so, because there's no production of value.)

Both cases are investing. Both are gambles, (but in either case you can only loose your initial investment as opposed to short selling, which is gambling of a most evil nature) but they are also investments, because if you do your homework you have a good chance of getting a return (on average).

Also note that most comodities (not gold) are generally futures. You are paying someone now on a product yet to come. (It's sort of the inverse Whimpy argument. I'd gladly pay you today for a hamburger Tuesday.) The maker of the product get less money but they get it sooner, so it can often be a win/win situation.

Of course you can also buy options (the right to buy or sell a product in the future at a certain price) on futures. Yea, that blows my mind too and I work with them every day.

I still think the biggest factor QE2 will override in the medium term any OBL effect. QE2 has been holdig up the stock market. Once QE2 ends in June the money will have to flow somewhere. Sovereign debt (bonds) is in poor favor these days so the logical place would have it flow into gold. Silver may or may not have been in a bubble, but that mini bubble will settle before June so it too may be a major benefactor in this, considering that it is easier to get silver coins than it is to get gold ones (your typical silver coin from Canada is around $100, while the same cost gold coin is like 1/25 oz and extreemely limited, most go for $1,000). Note that investment in coins is as much an investment in collector trends as in the metal itself. (Obligatory push for the Canadian Mint ... not to mention they have the coolest coins.)Juton wrote:It will be interesting to see how gold performs now that OBL has been killed, ...

You realize that the BPP is measuring online prices only, right? And that it's not weighted at all?Doom wrote:By the way, another pack of liars also says BLS is wrong. But MIT folks are just morons, I guess.

-

DSMatticus

- King

- Posts: 5271

- Joined: Thu Apr 14, 2011 5:32 am

Colorful. But that disturbing bit aside, I didn't have to put anything in your mouth - you were more than willing to quote the obvious garbage that is shadowstats yourself (and first, no less, as though it were the most authentic source you could find), and those numbers are ridiculous. Is the government undershot? Maybe. But the actual inflation being upwards of a factor of 2-3? Lolno. There is a middle ground here - you don't have to believe the government's methods are perfect to realize shadowstat's are flat out wrong.Uh, DSMatticus, you think having sex with 8 year old boys is fun, and you're posting here?

In other words, try not putting words in my mouth, please.

But nobody's going to convince eachother here, so we should probably let this go. More interesting things to talk about.

Yes. That's exactly what I said. All expenditures are gambles. Not investing money is a gamble - the dollar could fall relative to something. By some metric, we're losing gambles all the time that we aren't even aware we're making. I flat out said that. Investments in capital are gambles.Sure, one's a gamble, another's a bigger gamble. Kinda like betting on Red in roulette, as opposed to betting on #23. You want to call the former an investment, and the latter a gamble, you go right ahead, but it is just a question of semantics.

Again, I said investments in capital are gambles. Capital fails. That totally happens, and I never said it didn't. What are you arguing with me? Apparently nothing.Suppose you bought stock in a typewriter company in 1900...that's an investment, right? If you kept stock for the last 111 years, you've made infinite capital, right? Nope, almost all typewriter companies are wiped out, now. Now, if you pulled that 'capital' out 40 years ago, and 'invested' in something else, it looks good. But a gamble really is a gamble, honest.

Okay, you apparently missed something...Even more so, you say yourself. So, you agree.

Do you see that bolded bit? Okay, then we're good. All expenditures are gambles of relative risk/reward. Moving on, because that wasn't my point at all. My point was when you invest in capital, you are expending resources to generate more or better capital. When you invest in commodities, you generate nothing. All you can do is make money by selling it higher than you bought it. You make money producing nothing - and if you don't see how it's bad to reward people economically for contributing nothing to society except their ability to gather other people's money very efficiently into their pockets... well, why do you think these bubbles keep popping up? They're fantastic for business, and everybody makes out like a crook. Speculating on things to increase their worth, then bailing, makes you tons of money. Unfortunately, the rest of the people, who actually have to live and use the commodities you're speculating on and depend on the stability of the economies that use them... suffer really fucking hard.DSMatticus wrote:The first is the idea of investing in capital, with the expectation that that capital will produce more capital or different capital. (Cows make more cows, meat, or milk. You have more capital than you did before. Is investment gambling? Yes.)

Wait, are you asking me to call Alan Greenspan an idiot? You're a kind soul - I'd love to. Alan Greenspan's an idiot.Been 10 straight years of people saying that, and it's completely insane to say it. Gold's value is its value, nothing more. Gold is money, according to former Alan Greenspan...do you think the head of the US treasury is clueless, too?

But that said, you're right - gold's value is its value. Except of course there is in fact more. In the same way a house's value is its value, and there was in fact a housing bubble that was artificially inflating that value. Whether gold is 'bubbling' or not, who knows. Its value has been spiking pretty hard. I think it'd be a good time to sell, is what I'll say.

No it's not, it's pretty obvious. Gold has a value, and that value happens to be X in a stable market environment. Heavy amounts of speculation on gold (which is basically all gold is good for, drawing speculators) can raise that price well beyond X. But you're right, gold itself doesn't actually hurt the economy, because gold actually has very few uses, and the uses it has it's too expensive for.It's queer how folks can say "gold is worthless and meaningless" on one hand, and "it's horrible for the economy" on the other, and see no disconnect. It's usually the same ones who think buying gold is the same thing as eating gold.

Imagine heavy speculation on commodities like food. Do you understand how that is bad for the people who have to... you know? Eat? Or how the housing bubble has destroyed people's lives? (Though, that wasn't exactly pure speculation. There were a lot of other things going on there.) Speculation hurts.

Well, tzor, that's still a very abstract form of capital investment. Investing in a corporation is buying a piece of capital, and the corporation gets your money (or it did for selling the stock in the first place, even if you're buying the stock 2nd, 3rd, or 100th hand), and it uses that to expand its business. If expansion is successful, you now have more capital than you did before. And the economy is overall more valuable, because it now includes a more successful business. You have both contributed to the economy and profited in doing so, and that's fine.Tzor wrote:Many shares of equity stock do not give "dividends." Then where is the "profit?" The same as the comodity. You hold it under the assumption that over time more people will want it; thus resulting in an increase of the price. You may be surprized at how many major stocks do not have dividends.

The problem is speculation doesn't actually contribute to the economy - it only moves wealth from person to person. And in the meantime, the prices of those commodities become incredibly unstable. If those commodities are things people want or need, speculation literally hurts those people.

Other than the lies, no, you didn't. So, just the lies then, in my mouth. Don't do that again, please.DSMatticus wrote: Colorful. But that disturbing bit aside, I didn't have to put anything in your mouth -

Sigh, again with the fundamental misunderstanding. Of course Shadowstats numbers are 'wrong'...they're using the government numbers. Sigh.you were more than willing to quote the obvious garbage that is shadowstats yourself (and first, no less, as though it were the most authentic source you could find), and those numbers are ridiculous.

The fact that Shadowstats is as sane as BLS is actually the point...there's a reason why, but I'm giving up on saying it over and over again.

Indeed. I keep saying 3^(-1) is 1/3, and I'll never, ever convince you that it's not -3. Just have to agree to disagree on that.But nobody's going to convince eachother here, so we should probably let this go. More interesting things to talk about.

Money that could, like, be used to invest in what you call a 'real' investment.When you invest in commodities, you generate nothing. All you can do is make money by selling it higher than you bought it.

Let's go over that carefully: you can take commodity profits and use them to invest in other things that are also investments/gambles/whatever.

So, no difference at all.

One thing has little if anything to do with the other. Sometimes simply preserving capital is a better deal than throwing it away on stock.You make money producing nothing - and if you don't see how it's bad to reward people economically for contributing nothing to society except their ability to gather other people's money very efficiently into their pockets...

Suppose we had 2 workers each with lots of Enron stock right before the annihilation. One sells his stock, and buys all he needs (commodities) for retirement. The other keeps his stock and has his retirement account wiped out, forcing him to live on welfare, forcing his kids to pump gas instead of going to college.

And the first guy is BAD, contributing nothing to society, right?

A wild scattershot thing to say. Bubbles in general happen, rather like tornadoes...simply too many answers to that question.well, why do you think these bubbles keep popping up?

Man, it's really bad, but everybody makes out like a crook. Hmm.They're fantastic for business, and everybody makes out like a crook. Speculating on things to increase their worth, then bailing, makes you tons of money.

This is the classic government school line. There's a book you should read, "Defending the Indefensible", you should read it. It rather explains how we really shouldn't hate the people we've been trained so well to hate.Unfortunately, the rest of the people, who actually have to live and use the commodities you're speculating on and depend on the stability of the economies that use them... suffer really fucking hard.

Well, like I've said many a time, let's come back to that in a year. The 'official' death of OBL might make a difference in the short term (especially with the recent run-up).I think it'd be a good time to sell, is what I'll say.

Oh wow. Again.Heavy amounts of speculation on gold (which is basically all gold is good for, drawing speculators) can raise that price well beyond X. But you're right, gold itself doesn't actually hurt the economy, because gold actually has very few uses, and the uses it has it's too expensive for.

Oh wow. Again. You should definitely look into that book.Imagine heavy speculation on commodities like food. Do you understand how that is bad for the people who have to... you know? Eat? Or how the housing bubble has destroyed people's lives? (Though, that wasn't exactly pure speculation. There were a lot of other things going on there.) Speculation hurts.

Last edited by Doom on Tue May 03, 2011 5:00 am, edited 1 time in total.

-

Username17

- Serious Badass

- Posts: 29894

- Joined: Fri Mar 07, 2008 7:54 pm

Heh, you should read the comments section of folks laughing at that 'analysis'. His graphs don't even INCLUDE the billionprices project. We just have to take it on faith.

Highlights of the more kind posts:

I'm only seeing one line on each graph. Shouldn't there be two?

Assuming the blue line is behind the red line, I'd say they match up REALLY well!

Tried just the food-looks like a different wave and couldn't dig up what you were looking for.

Hard to follow your methodology. You appear to have made up a new index of your own,..

That said, I do grant that some limited version of some aspect of a narrow range of some part of the billion prices project might well match some part of a version of a form of BLS statistics.

But I think a more general view makes more sense. Opinions will always differ on this sort of thing.

Highlights of the more kind posts:

I'm only seeing one line on each graph. Shouldn't there be two?

Assuming the blue line is behind the red line, I'd say they match up REALLY well!

Tried just the food-looks like a different wave and couldn't dig up what you were looking for.

Hard to follow your methodology. You appear to have made up a new index of your own,..

That said, I do grant that some limited version of some aspect of a narrow range of some part of the billion prices project might well match some part of a version of a form of BLS statistics.

But I think a more general view makes more sense. Opinions will always differ on this sort of thing.

Last edited by Doom on Tue May 03, 2011 5:41 am, edited 1 time in total.

-

DSMatticus

- King

- Posts: 5271

- Joined: Thu Apr 14, 2011 5:32 am

@Doom, most of your post is an attempt to condescend without providing substance (which is significantly less interesting than condescending with substance, so if you're going to try to do one I'd love to get you to try to do the other), so I'll pick out the parts that are vaguely meaningful and respond.

An economy is the sum of the wealth that exists in the economy. This is a pretty obvious statement. You're as rich as the sum of the shit you have.

What I'm saying is that investing in capital is capable of generating more capital, and thereby giving you more shit that you have. Speculating in commodities does not do this. It takes money from other people who have paid into the commodities, and puts it in your pocket. When lots of people speculate together, you get aberrant market behavior.

And most bubbles are very much man-made. They do not just happen. Bubbles happen because the market randomly fluctuates, and people try to profit off these fluctuations by predicting them and investing in them before they happen. But this is a self-fulfilling prophecy - the investment in a subset of the economy expecting to fluctuate 'up' causes it to inflate 'up', and you get a bubble.

When I say 'everybody,' I mean the people who bail on time. Then there are the people who do not bail on time (i.e., the people who buy the falling commodities from the people who are bailing on time), or the people who actually work to create these commodities, or need them as a part of their life. Those people do not make out like a crook, they are the people who get destroyed.

Again, I don't know how you are so completely and utterly missing my point. Is this deliberate? I'm not talking about gambling with you, at all. Let me make it clearer.Money that could, like, be used to invest in what you call a 'real' investment.

Let's go over that carefully: you can take commodity profits and use them to invest in other things that are also investments/gambles/whatever.

So, no difference at all.

An economy is the sum of the wealth that exists in the economy. This is a pretty obvious statement. You're as rich as the sum of the shit you have.

What I'm saying is that investing in capital is capable of generating more capital, and thereby giving you more shit that you have. Speculating in commodities does not do this. It takes money from other people who have paid into the commodities, and puts it in your pocket. When lots of people speculate together, you get aberrant market behavior.

No, Enron is bad for steering their company into a self-profiting failure. And you point out a wonderful issue - these sorts of things can be great for individuals. That's why people do them. My point is that they are bad for the economy, because while he engages in commodity speculation and gets wealthy, if that commodity happened to be food, somebody somewhere is probably starving to death. Well, not with the prices of food being what they are - food is pretty much post scarcity here. But if you go with the example of housing, people are literally living in trailers now because some people made money off that bubble. It's great for those who got it right, but bad for everyone else. Is that not clear?One thing has little if anything to do with the other. Sometimes simply preserving capital is a better deal than throwing it away on stock.

Suppose we had 2 workers each with lots of Enron stock right before the annihilation. One sells his stock, and buys all he needs (commodities) for retirement. The other keeps his stock and has his retirement account wiped out, forcing him to live on welfare, forcing his kids to pump gas instead of going to college.

And the first guy is BAD, contributing nothing to society, right?

You can stop bubbles. They're a product of our existing financial system and regulations. They are completely stoppable, but we choose not to, mostly because people like Alan Greenspan are the ones making those choices, and they're dicks.A wild scattershot thing to say. Bubbles in general happen, rather like tornadoes...simply too many answers to that question.

And most bubbles are very much man-made. They do not just happen. Bubbles happen because the market randomly fluctuates, and people try to profit off these fluctuations by predicting them and investing in them before they happen. But this is a self-fulfilling prophecy - the investment in a subset of the economy expecting to fluctuate 'up' causes it to inflate 'up', and you get a bubble.

I don't know if you actually misunderstood what I meant by everybody, or if you're just ignoring it to make a refutation of my point that is in fact not a refutation.Man, it's really bad, but everybody makes out like a crook. Hmm.

When I say 'everybody,' I mean the people who bail on time. Then there are the people who do not bail on time (i.e., the people who buy the falling commodities from the people who are bailing on time), or the people who actually work to create these commodities, or need them as a part of their life. Those people do not make out like a crook, they are the people who get destroyed.

I'm glad you can vaguely understand some things, but there really is much confusion.DSMatticus wrote:@ so I'll pick out the parts that are vaguely meaningful and respond.

But it can preserve capital and prevent the misallocation of resources. For example, 'speculating' in grain could be a good thing. Price rise, people don't waste it, and the speculator has many silos full of grain. Evil, evil, speculator. If the next 5 harvests fail, lots of folks don't die. By speculating, the food's been saved for a real emergency, instead of squandered.What I'm saying is that investing in capital is capable of generating more capital, and thereby giving you more shit that you have. Speculating in commodities does not do this.

People not dying is GOOD, and your economy is nothing if everyone is dead. In my opinion, of course. I've just provided an example of commodity speculation not just increasing an economy, but utterly saving it.

You've only heard one side of speculation...Defending the Undefendable gives a more fair account.

Or you prevent it, since you could have speculators on both sides of the equation. It can be bad, sure, but it can also be good. Stop reciting what you've been told, and think about it, if nothing else.When lots of people speculate together, you get aberrant market behavior.

Good, so it IS ok for human beings to speculate. Glad to see I'm turning you around on this.No, Enron is bad for steering their company into a self-profiting failure. And you point out a wonderful issue - these sorts of things can be great for individuals.

Unless lack of speculation causes everyone to die (cf, above). Really, you should get that book; your whole life you've only heard one side of the story. You probably think misers, blackmailers, and strip-miners are horrible, also.My point is that they are bad for the economy,

So, some speculators win, some lose. Yeah, that's like completely different from stock. Granted, the housing bubble has much to be said about it...but you do know some of those folks living in trailers now were speculators, too, right?But if you go with the example of housing, people are literally living in trailers now because some people made money off that bubble. It's great for those who got it right, but bad for everyone else. Is that not clear?

Oh wow. Again. I'm so hard pressed to respond to thinking like this. I don't mean to sound condescending, but do you seriously not see anything odd about what you just said here? Yes, people's actions can increase the size of a bubble (as you say later), but likewise those actions can reduce a 'bubble' to nothing.They do not just happen. Bubbles happen because the market randomly fluctuates,

But as you said (and negated when I said as much), random fluctuations are still the core, at least sometimes. Other bubbles have other reasons, of course, such as the local gas bubble that happens whenever a hurricane hits here (although I'm willing to concede a hurricane as a random thing).

Yes, some people win, some people lose. You know, businesses fail, stocks fail, all sorts of bad stuff can happen with other investments, and people get screwed indirectly all the time there, too.When I say 'everybody,' I mean the people who bail on time. Then there are the people who do not bail on time (i.e., the people who buy the falling commodities from the people who are bailing on time), or the people who actually work to create these commodities, or need them as a part of their life. Those people do not make out like a crook, they are the people who get destroyed.

(edit: the book is Defending the Undefendable, by Walter Block...sorry, really bad with names)

Last edited by Doom on Tue May 03, 2011 6:13 am, edited 4 times in total.

-

Username17

- Serious Badass

- Posts: 29894

- Joined: Fri Mar 07, 2008 7:54 pm

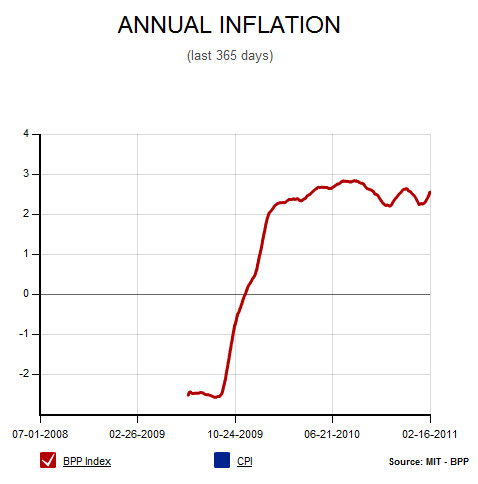

The missing blue line is the CPI, which for whatever reason the MIT server isn't showing. The Red Line is the BPP from the BPP's own servers. The Goods-only CPI number comes after it.Doom wrote:Heh, you should read the comments section of folks laughing at that 'analysis'. His graphs don't even INCLUDE the billionprices project. We just have to take it on faith.

Before dismissing things on the grounds of having bad charts, you should read what those charts actually say. Quoting idiots who can't be fucked to read a chart's axis labels in order to "prove" that the chart was faulty is just you proving yourself foolish.

So, here's the BPP (in Red):

And here's the Goods-only CPI (also in red):

Oh, and here is the CPI and the BPP together:

The BPP is updated more frequently (almost continuously), but tracks less things. So it's slightly different, but rounder.

But really the bottom line is that if you're relying on the BPP to show that the government are a bunch of liars about inflation you have failed to disprove the Null Hypothesis with your presented evidence.

-Username17

This is actually largely true, but I'm not sure you've thought through the consequences of of this truth. The thing is that you can't normally invest in money--or rather, you can, but only in the sense that speculators are investors.Doom wrote:Gold is money

If you buy stock in Microsoft, someone programs a new version of windows. If you buy a pile of dollar bills, or renminbi, and bury them in your back yard... no one programs anything.

-

DSMatticus

- King

- Posts: 5271

- Joined: Thu Apr 14, 2011 5:32 am

Again, this is such an incredible misunderstanding of what I actually said that it must be deliberate.Good, so it IS ok for human beings to speculate. Glad to see I'm turning you around on this.No, Enron is bad for steering their company into a self-profiting failure. And you point out a wonderful issue - these sorts of things can be great for individuals.

Or maybe you don't understand that just because something is good for one individual, it doesn't make it great for everyone? Here's an example: me taking all of your money would be great for me, and horrible for you. Wealth doesn't magically appear out of thin air, and it didn't in the case of Enron either.

Goldman Sachs absolutely loves that they made soooo much money off the latest economic collapse. That doesn't change the fact that it was a god damn economic collapse that they uncaringly orchestrated in order to profit off of.

By the way, while we're pretending to be deliberately obtuse and not understand eachother, did you just say that because it was great for the few individuals who profited off it, Enron was ok?

So wait, you're suggesting that speculators are the mechanism by which food is stored for bad harvests?But it can preserve capital and prevent the misallocation of resources. For example, 'speculating' in grain could be a good thing. Price rise, people don't waste it, and the speculator has many silos full of grain. Evil, evil, speculator. If the next 5 harvests fail, lots of folks don't die. By speculating, the food's been saved for a real emergency, instead of squandered.

Firstly, most speculation in agricultural commodities is completely separate from the actual physical commodity. As a matter of fact, most commodity trading is. Slips of paper get handed around that represent the agricultural commodity, meanwhile the actual agricultural commodities are being eaten or turned into something edible. There is no silo, there is no grain, there is an abstract promise that "if you really wanted it, and if you were willing to pay the delivery fees, we could go out and get the grain you theoretically own."

But even that aside, there is already a mechanism for storing food, and the farmer can do it himself - if he overharvests/overproduces, he takes his leftover product that he can't sell and puts it in a silo to sell at a later date. There is no commodity trader necessary.

And for every one time the situation you describe would happen (which will actually happen exactly 0 times in the modern world, I'm guessing), 10 times the speculator buys into grain, the price rises, people spend more of their budget on food, their quality of life drops, and he has papers representing grain. Eventually he wraps them up with some other investments, sells those investments to other people, and walks away laughing. The price of grain stabilizes back to its normal levels or lower, and grain farmers come dangerously close to losing their livelihoods from the sharp decline (their processing costs have been steadily creeping up to account for the increasing cost of grain). That's what actually happens.

Exactly. Not that we need another version of windows anytime soon.Orion wrote:If you buy stock in Microsoft, someone programs a new version of windows. If you buy a pile of dollar bills, or renminbi, and bury them in your back yard... no one programs anything.

I really don't think you're fully reading what I'm saying. Or at least, you're very good at ignoring the parts of it you didn't want to hear. That part I've bolded is for emphasis, because it's the important part of that that you completely ignored.Oh wow. Again. I'm so hard pressed to respond to thinking like this. I don't mean to sound condescending, but do you seriously not see anything odd about what you just said here? Yes, people's actions can increase the size of a bubble (as you say later), but likewise those actions can reduce a 'bubble' to nothing.They do not just happen. Bubbles happen because the market randomly fluctuates,

Small market fluctuations are normal. People try to profit off of small market fluctuations by buying when things fluctuate down and selling when they fluctuate high. Bubbles happen when a lot of people do this together (or a few people with a lot of money do it together) - the money they're pouring into it turns a small market fluctuation into a HUGE market fluctuation, because the increased demand sparks even further increased demand and even further increased demand and so forth and so on, and it feeds itself until somebody chickens out, cashes out, and the whole thing pops.

No, just demonstrating that speculators are not evil and that they can perform useful services, help the economy, and prevent misallocation of resources. I.e., you're wrong.DSMatticus wrote: So wait, you're suggesting that speculators are the mechanism by which food is stored for bad harvests?

Fine, so showing you you're wrong about speculation has be to be examples in the 'modern' world (although the example does work for several third world countries). Let's demonstrate it again.]And for every one time the situation you describe would happen (which will actually happen exactly 0 times in the modern world, I'm guessing),

Suppose a speculator buys a great deal of a cheap commodity, water. He invests in warehouses to store it in a major city. A hurricane comes, and the people in the city are stranded without water. They will literally die of thirst, except there's a speculator right there, willing to sell them water (that he gambled his own resources on).

One again...no speculator = people definitely die

speculator = some people definitely live.

Feel free to check back a few years, I'm sure you'll find some real world examples where a natural disaster cut of supplies to drinkable water for several days.

Another example, a friend of mine speculated on generators, bought dozens of the things. When the last hurricane threatened, he loaded up his truck and sold them on the corner, making profits. He provided a valuable service, protected capital, prevented the misallocation of resources by people that didn't buy generators sooner, and every single person who bought his generators was *happy* to get them, and, again, people had more stuff (the contents of their refrigerators) than before, thanks to his speculation.

So, once again, demonstrated that speculators can be useful and add to the economy...or do you want to move the goalposts again?

I didn't ignore it, I acknowledged it. But the fact remains that you admitted that bubbles are random...and in the same line say they don't 'just happen'. It's as bizarre as saying gold isn't useful while you're typing on a computer (which, if I removed the gold from it, would no longer function).I really don't think you're fully reading what I'm saying. Or at least, you're very good at ignoring the parts of it you didn't want to hear. That part I've bolded is for emphasis, because it's the important part of that that you completely ignored.

Or, as discussed earlier, when a natural disaster or other random causes a fluctuation in the supply chain.Bubbles happen when a lot of people do this together (or a few people with a lot of money do it together)

Once again, you're only seeing half of the equation when it comes to speculators. Please, please, open you're mind to more than just you've been told before.

Last edited by Doom on Tue May 03, 2011 2:09 pm, edited 2 times in total.