Silicon Valley Bank collapse and its effects

Moderator: Moderators

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

@Kaelik

It looks like you don't have any data for 2023?

Stimulus Payments went out in 2020 and 2021. No stimulus payments went out in 2022. If you're doing a one-year lookback you'd expect that your income sans stimulus would be lower than your income with stimulus unless you took a new job or got a raise that equaled or exceeded that stimulus.

Please note that I'm not saying that is the only reason or even the main reason that some people saw a decrease. I would expect that inflation is the biggest culprit - prices rose faster than wages in most of 2022. So my article about 'real wage growth leading inflation' would be relevant and could indicate that extending your chart into 2024 would show a reversal - more people earning more money than they were before which is obviously a good thing.

It looks like you don't have any data for 2023?

Stimulus Payments went out in 2020 and 2021. No stimulus payments went out in 2022. If you're doing a one-year lookback you'd expect that your income sans stimulus would be lower than your income with stimulus unless you took a new job or got a raise that equaled or exceeded that stimulus.

Please note that I'm not saying that is the only reason or even the main reason that some people saw a decrease. I would expect that inflation is the biggest culprit - prices rose faster than wages in most of 2022. So my article about 'real wage growth leading inflation' would be relevant and could indicate that extending your chart into 2024 would show a reversal - more people earning more money than they were before which is obviously a good thing.

-This space intentionally left blank

Re: Silicon Valley Bank collapse and its effects

It includes welfare. That means one of the many welfare programs that was then cut is one of the reasons. But so are the other welfare programs that were also cut.deaddmwalking wrote: ↑Wed Feb 07, 2024 7:26 pm@Kaelik

It looks like you don't have any data for 2023?

Stimulus Payments went out in 2020 and 2021. No stimulus payments went out in 2022. If you're doing a one-year lookback you'd expect that your income sans stimulus would be lower than your income with stimulus unless you took a new job or got a raise that equaled or exceeded that stimulus.

Please note that I'm not saying that is the only reason or even the main reason that some people saw a decrease. I would expect that inflation is the biggest culprit - prices rose faster than wages in most of 2022. So my article about 'real wage growth leading inflation' would be relevant and could indicate that extending your chart into 2024 would show a reversal - more people earning more money than they were before which is obviously a good thing.

"Real Wage Growth outpacing inflation" does not in fact mean anything unless real wage growth outpaces inflation by several thousand dollars for the poorest americans, because various welfare cuts have been several thousand dollars.

And since the point I'm making is that people are poorer now then 2-3 years ago, before all these various welfare cuts, 2023 data would have to show a combined 34% shift in these two numbers in 2023 in the exact opposite direction as they went the last two years before my statement wasn't true including 2023. (Technically this still wouldn't prove they had more disposable income then they had in 2020 or 2021, but it's okay, because that didn't happen so it doesn't matter what it would prove.)

Want to bet that the number of people with more disposable income in 2023 wasn't 60% vs 40% with less in a year where 14 million people were kicked off medicare who had it in 2022?

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

Re: Silicon Valley Bank collapse and its effects

Why would you be asking for more data when it you think about the chart you posted actually means rationally you can figure it out for yourself? Every year according to the chart you posted about 50% of Americans don't see their wages outpace inflation. The number of those who fell behind went up for a couple of years. That's the information you provided. 59% didn't see significant wage growth in 2023 (the catch up year). Again this is all in the numbers you randomly decided to give. What numbers are you looking at that suggests these 50% of Americans are making more money?

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

I wouldn't care to take any bets with you if you're unwilling to define your terms. The data I find says that 65 million people were enrolled at the end of 2022, and 66 million were enrolled in October 2023. Based on changes to plans in March, costs for Medicare premiums (when applicable) decreased and the cost of prescription drugs also decreased.

While I am a proponent of single-payer universal coverage, I recognize that a decrease in Medicare enrollment isn't necessarily the same as an increase in the total uninsured population. In 2013 the number of uninsured was 44 million; the number in 2022 was 25.6 million; not only was this a decrease in the total number of uninsured, it was a decrease in the uninsured rate. Source

-This space intentionally left blank

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

My post and figures were saying 'hey, you know how that bad thing where people's buying power was decreasing because prices are going up faster than wages? That's ending'. So yeah, the chart showing the bad thing and the article saying 'the bad this is ending' should be pretty easy to interpret.MGuy wrote: ↑Wed Feb 07, 2024 8:13 pmWhy would you be asking for more data when it you think about the chart you posted actually means rationally you can figure it out for yourself? Every year according to the chart you posted about 50% of Americans don't see their wages outpace inflation. The number of those who fell behind went up for a couple of years. That's the information you provided. 59% didn't see significant wage growth in 2023 (the catch up year). Again this is all in the numbers you randomly decided to give. What numbers are you looking at that suggests these 50% of Americans are making more money?

-This space intentionally left blank

Re: Silicon Valley Bank collapse and its effects

So I specifically talked about what you are looking at to tell you how Americans that were falling behind inflation are making more money in that thing you quoted. I did not ask about your views on 'buying power' because you can get more buying power by working more overtime, getting a second job, or ubering on the side. So more buying power doesn't mean I'm effectively making more money.

So again, by the data you provided, something like 50% of Americans have been falling behind inflation. Even more so prior to this catch up year of 2023. The effects of these things are cumulative and so would track all the way through 2023 to today. What data are you looking at that suggests these people are making more money?

So again, by the data you provided, something like 50% of Americans have been falling behind inflation. Even more so prior to this catch up year of 2023. The effects of these things are cumulative and so would track all the way through 2023 to today. What data are you looking at that suggests these people are making more money?

Last edited by MGuy on Wed Feb 07, 2024 9:05 pm, edited 1 time in total.

Re: Silicon Valley Bank collapse and its effects

What if instead of trying to "define my terms" by making up a new completely unrelated thing that I didn't say and then citing an irrelevant stat that has nothing to do with the thing I said you just Googled the thing I said.deaddmwalking wrote: ↑Wed Feb 07, 2024 8:22 pmI wouldn't care to take any bets with you if you're unwilling to define your terms. The data I find says that 65 million people were enrolled at the end of 2022, and 66 million were enrolled in October 2023. Based on changes to plans in March, costs for Medicare premiums (when applicable) decreased and the cost of prescription drugs also decreased.

While I am a proponent of single-payer universal coverage, I recognize that a decrease in Medicare enrollment isn't necessarily the same as an increase in the total uninsured population. In 2013 the number of uninsured was 44 million; the number in 2022 was 25.6 million; not only was this a decrease in the total number of uninsured, it was a decrease in the uninsured rate. Source

Then you could see how biden allowed people to start being kicked off medicaid in April, and 2 million had been kicked off in June, and 7 million in September, and 15 million for the year. Which you can find in various articles hroughout the year covering how the end of pandemic medicaid was predicted to kick about 15 million people off medicaid and also, that a bunch of people were kicked off medicaid consistent with this until the number was 15 million in January of 2024.

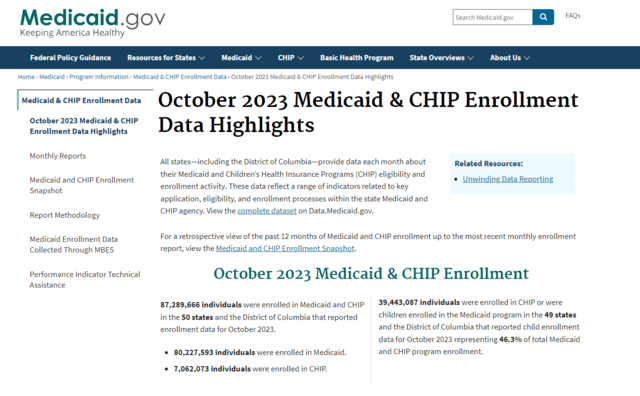

It is baffling that you respond to extremely well know things you definitely have heard of by citing to unrelated stats that are also wrong because an extremely cursory search could tell you that 80 million people were on medicaid in October 2023 and 90 million in 2022.

How the fuck did you even come up with these fake ass 60 million numbers? Did you Google "medicaid enrollment up" and post what you found on the drudge report like you did for obama's wealth?

Why stupid dumb Medicare.gov posting these LIES about 80 million people. Deaddm, the stats guru, knows the real number is 66 million for some fucking reason.

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

Kaelik,

You know that Medicare and Medicaid are different government programs, even though they do similar things (provide health coverage for people). If you can't accurately tell me what program you're discussing than obviously I can't be expected to know what you're talking about. And if you're not willing to 'define your terms' when you can't even be counted on to let me know what program you're talking about, I think that's a problem.

Actually more buying power does mean you're effectively making more money. Welcome to Tautology club! I mean, technically if we were in a deflationary environment where prices were going down and your wages remained the same you could have increased buying power, but we're not, so regardless of how you're making extra money, making extra money does in fact mean that you're making extra money.MGuy wrote: ↑Wed Feb 07, 2024 8:58 pmSo I specifically talked about what you are looking at to tell you how Americans that were falling behind inflation are making more money in that thing you quoted. I did not ask about your views on 'buying power' because you can get more buying power by working more overtime, getting a second job, or ubering on the side. So more buying power doesn't mean I'm effectively making more money.

I'm included in the statistic of 'decreased income in 2023' - to the tune of $25k! But I am cautiously optimistic that household income will be more in 2024 than it was in 2022 and am fairly confident it will be higher than in 2022. - An increase like that will make me feel good about the economy. And if that's cause I'm picking up a side-gig doing a rideshare service or my job is reclassified and I'm earning overtime, well, at the end of the day I can get ahead on some of my financial obligations. Those have gone up, too! While my situation isn't everyone's situation and an anecdote isn't data, if things are improving for me there's a real chance that they're improving for other people, too. And wouldn't that be nice?

-This space intentionally left blank

-

PseudoStupidity

- Master

- Posts: 240

- Joined: Thu May 13, 2021 4:11 pm

Re: Silicon Valley Bank collapse and its effects

What if we also talked about housing and rent prices? That shit has gone absolutely bananas in the US and, while rent increases are cooling a bit now, rent is up significantly and home prices are just totally out of reach for anyone who isn't wealthy or in the middle of nowhere. People in the US are, on average, simply worse off today than they were in, say, 2019.

Here's some crap about rents: https://www.nerdwallet.com/article/fina ... ket-trends

I don't think a source is needed for the cost of a home or the interest rates on mortgages.

Also worth mentioning that gaining a couple hundred dollars of spending power a year is the expectation, and indeed the promise, of living under capitalism that we were and are all sold. Meeting that is not a triumph, but not meeting that expectation is a failure to basically anyone who lives in a capitalist economy while letting wages fall behind inflation is a spectacular failure.

Here's some crap about rents: https://www.nerdwallet.com/article/fina ... ket-trends

I don't think a source is needed for the cost of a home or the interest rates on mortgages.

Also worth mentioning that gaining a couple hundred dollars of spending power a year is the expectation, and indeed the promise, of living under capitalism that we were and are all sold. Meeting that is not a triumph, but not meeting that expectation is a failure to basically anyone who lives in a capitalist economy while letting wages fall behind inflation is a spectacular failure.

Last edited by PseudoStupidity on Wed Feb 07, 2024 9:47 pm, edited 1 time in total.

Re: Silicon Valley Bank collapse and its effects

Well thank you for agreeing with me that talking about buying power is useless I guess. Though you don't need that many words to say you're right.

More importantly you still haven't produced have any data to back up the claim that people who are (and presumably have been) losing in this economy even by the metrics you decided to post. All you just said is that you hope that some time in the future it'll pan out... By your own chart all signs point to the fact that it's unlikely to get to a good place. It tracks back to 2016 and the latest climb only gets back to it being worse than at that time when things were already bad. It doesn't show the spread of these wage raises so I don't know if the same Americans are experiencing this effective loss year after year but I assume that's mostly the case and even if that holds true for most or if it changes year to year that doesn't seem like a sign because the effects of falling behind are cumulative. At the best portions of the data you present things are still bad and so you're effectively hoping things get back to being bad after people have already fallen way behind.

More importantly you still haven't produced have any data to back up the claim that people who are (and presumably have been) losing in this economy even by the metrics you decided to post. All you just said is that you hope that some time in the future it'll pan out... By your own chart all signs point to the fact that it's unlikely to get to a good place. It tracks back to 2016 and the latest climb only gets back to it being worse than at that time when things were already bad. It doesn't show the spread of these wage raises so I don't know if the same Americans are experiencing this effective loss year after year but I assume that's mostly the case and even if that holds true for most or if it changes year to year that doesn't seem like a sign because the effects of falling behind are cumulative. At the best portions of the data you present things are still bad and so you're effectively hoping things get back to being bad after people have already fallen way behind.

Re: Silicon Valley Bank collapse and its effects

So are you saying you took advantage of my phones autocorrect to present a pointless bad faith post to waste time?deaddmwalking wrote: ↑Wed Feb 07, 2024 9:28 pmKaelik,

You know that Medicare and Medicaid are different government programs, even though they do similar things (provide health coverage for people). If you can't accurately tell me what program you're discussing than obviously I can't be expected to know what you're talking about. And if you're not willing to 'define your terms' when you can't even be counted on to let me know what program you're talking about, I think that's a problem.

Or are you saying that you legitimately believed that I was saying Joe Biden had ordered the immediate liquidation of 14 million old people as a welfare cut?

Now this is slightly ruined by your typo, so it's not clear what you are even saying. And if I were you, I would make a 600 word post where I insult you for not knowing that 2022 and 2022 are the same years, but this is so emblamatic of how your brain is hyper broken by your instinctual need to promote whatever pro Biden talking points your script spits out.deaddm wrote:I'm included in the statistic of 'decreased income in 2023' - to the tune of $25k! But I am cautiously optimistic that household income will be more in 2024 than it was in 2022 and am fairly confident it will be higher than in 2022. - An increase like that will make me feel good about the economy.

If someone was making (all numbers adjusted for real wage in relation to inflation) 35k in 2021, and then 30k in 2022 and then 25k in 2023, and they EXPECTED to make 30k in 2024..... That is a person who would not normally say they feel good about the economy! That is someone who thinks the economy is looking pretty shit! Quiet aside from this reflecting badly on Joe Biden, specifically, If you are hoping to make approximately what you made a couple years ago after a big dip, that doesn't make you think things are going great!

Being worse off then a couple years ago by slightly better then the worst recent year is not a cause for optimism. It's a fucking reason to think things suck.

But also, just to stress, nothing that happens to wages addresses the fact that people have experienced massive welfare cuts.

Last edited by Kaelik on Wed Feb 07, 2024 10:08 pm, edited 1 time in total.

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

Re: Silicon Valley Bank collapse and its effects

I want to highlight that even in the hypothetical kaelik presents here that the numbers dead posted suggest you wouldn't be back to even 2021 money wise AND that only 41% of Americans would've seen that, if any, uptick. So you don't need to invent reasons for people to recognize that they are effectively making less money. They effectively are.

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

Regarding my typo, I did mean to say that I was pretty certain I will make more in 2024 than in 2023, and hopeful to make more than I did in 2022. It is a fact that I made more in 2023 than I did in 2021. 2022 was a particularly good year for me, personally, so I didn't really expect to make as much the following year. I don't think most people expect that every year will be a real increase in spending power - most people seem to expect a raise that more-or-less keeps up with inflation unless they change jobs or get promoted.

Extrapolating

Regarding Kaelik's typo, well, Medicare and Medicaid are different programs. You tend to get pretty upset if I presume you didn't mean what you said. Regarding Medicaid, it appears that 84.7 million people were covered in 2021, 90.8 were covered in 2022, and 87.2 million were covered in October 2023 Source. A decrease of 3 million is significant and important - if that truly represents a loss of medical coverage that is a travesty (that would be fixed by single-payer universal coverage). But I don't see how 3 million is 15 million. I can also imagine situations where moving from Medicaid to a different type of coverage would be a net positive for the people involved.

But as far as 'are things getting better' in general, I think that argument could be made. Fewer than 73 million people had Medicaid in 2019, so if that's where we're judging from, a 25% increase in coverage seems generally positive!

There just isn't really good data on 2023 yet, but there will be! But it's interesting how in 2019 real wages finally caught up to where they were in 1973. Real wages fell until 1990 and have been (generally) increasing since then. It does look like they went up in 2021 and are basically where they were in 2019, which except for the two pandemic years with all that stimulus means it's the highest it's been in basically 50 years. That's some positive economic news.

But I get where you're coming from. Things have been bad. People have been hurting. It takes a long time for positive changes to make a meaningful difference in people's lives. Here I am pointing out a crocus saying 'spring is coming' after a long and terrible winter, and it's still cold outside. But that doesn't mean spring isn't coming. It's not an eternal winter. There's reason to be optimistic. I'm excited about that.

Extrapolating

Regarding Kaelik's typo, well, Medicare and Medicaid are different programs. You tend to get pretty upset if I presume you didn't mean what you said. Regarding Medicaid, it appears that 84.7 million people were covered in 2021, 90.8 were covered in 2022, and 87.2 million were covered in October 2023 Source. A decrease of 3 million is significant and important - if that truly represents a loss of medical coverage that is a travesty (that would be fixed by single-payer universal coverage). But I don't see how 3 million is 15 million. I can also imagine situations where moving from Medicaid to a different type of coverage would be a net positive for the people involved.

But as far as 'are things getting better' in general, I think that argument could be made. Fewer than 73 million people had Medicaid in 2019, so if that's where we're judging from, a 25% increase in coverage seems generally positive!

There just isn't really good data on 2023 yet, but there will be! But it's interesting how in 2019 real wages finally caught up to where they were in 1973. Real wages fell until 1990 and have been (generally) increasing since then. It does look like they went up in 2021 and are basically where they were in 2019, which except for the two pandemic years with all that stimulus means it's the highest it's been in basically 50 years. That's some positive economic news.

But I get where you're coming from. Things have been bad. People have been hurting. It takes a long time for positive changes to make a meaningful difference in people's lives. Here I am pointing out a crocus saying 'spring is coming' after a long and terrible winter, and it's still cold outside. But that doesn't mean spring isn't coming. It's not an eternal winter. There's reason to be optimistic. I'm excited about that.

-This space intentionally left blank

Re: Silicon Valley Bank collapse and its effects

No one is arguing against the possibilty that things could get better. They always can. What this exposes, and what should give dead and anyone else who did the same pause, is how fully this narrative was bought into. Instead of thinking about what these numbers mean the first instinct was just to buy into what that axios writer 'said'. Even when someone pointed out what this data really says about how it is actually true that many people are making less money.

Not that further confirmation that some people only believe what they are told to believe is at all surprising given I have said as much multiple times. Still I really can't comprehend how someone looks at that data and witnesses proof that %50 of Americans actively getting fucked (according to the measuring stick they decided to use) and dismiss that as if they are suffering from some kind of delusion about their economic situation. I love somebody assuring me that I have more money in my pocket while I am actively having to tighten my belt for the latest rent hike.

Not that further confirmation that some people only believe what they are told to believe is at all surprising given I have said as much multiple times. Still I really can't comprehend how someone looks at that data and witnesses proof that %50 of Americans actively getting fucked (according to the measuring stick they decided to use) and dismiss that as if they are suffering from some kind of delusion about their economic situation. I love somebody assuring me that I have more money in my pocket while I am actively having to tighten my belt for the latest rent hike.

Re: Silicon Valley Bank collapse and its effects

I think most people EXPECT that they will get a raise half of inflation in bad inflation years, and less then inflation but only slightly in good inflation years, and then, either get a promotion or be unable to sustain themselves and look for a different job that pays more.deaddmwalking wrote: ↑Wed Feb 07, 2024 10:50 pmI don't think most people expect that every year will be a real increase in spending power - most people seem to expect a raise that more-or-less keeps up with inflation unless they change jobs or get promoted.

This is mostly born out in that when you look into the specifics, people who stayed at the same job have not in fact experienced real wage growth for the most part, and instead, where there is real wage growth it has mostly come from people changing jobs.

And yet, you didn't respond to my claim that Joe Biden liquidated 14 million old people as if you believed I had made that claim, so I'm thinking you knew that I wasn't claiming that.deaddmwalking wrote: ↑Wed Feb 07, 2024 10:50 pmRegarding Kaelik's typo, well, Medicare and Medicaid are different programs. You tend to get pretty upset if I presume you didn't mean what you said.

1) A fucking 12 year old could tell you that this isn't a way to tell how many people got kicked off. A fucking 7 year old could google how many people were kicked off. Can you figure out why comparing the numbers at time X and time Y would not tell you how many people were kicked off medicaid? Do I need a blue dog to point at clues?deaddmwalking wrote: ↑Wed Feb 07, 2024 10:50 pmRegarding Medicaid, it appears that 84.7 million people were covered in 2021, 90.8 were covered in 2022, and 87.2 million were covered in October 2023 Source. A decrease of 3 million is significant and important - if that truly represents a loss of medical coverage that is a travesty (that would be fixed by single-payer universal coverage). But I don't see how 3 million is 15 million. I can also imagine situations where moving from Medicaid to a different type of coverage would be a net positive for the people involved.

2) 87 million is Medicaid and CHIP. CHIP is a different program, and not included in the 90 million figure in 2022, though the correct number including CHIP is only 92 million at the end of 2022, and then roughly 95 million in March of 2023 before the cuts began and the number started going down for the total combined. CHIP has been rapidly expanding while medicaid expanded until the cuts went into effect.

No, where we are judging from, would of course under even your stupid standards, be from 2020, because Biden became president in 2021. But also, and this is moderately important. WE ARE NOT DOING SNAPSHOTS OF SOME SPECIFIC YEAR BEFORE BIDEN TOOK OFFICE. 15 million people got kicked off medicaid last year. They had welfare cuts. They had to deal with that. It doesn't matter whether they had welfare in 2019! It matters that they had welfare, and it was cut, which means they lost money relative to before it was cut, unless they somehow got a simultaneous raise of a few thousand dollars. So they are worse off now then they were recently, and have a good reason to think the economy is worse, because it's worse for them.deaddmwalking wrote: ↑Wed Feb 07, 2024 10:50 pmBut as far as 'are things getting better' in general, I think that argument could be made. Fewer than 73 million people had Medicaid in 2019, so if that's where we're judging from, a 25% increase in coverage seems generally positive!

No, that is not what I am saying you turing test failing talking point robot. I am saying that people RIGHT NOW IN 2024 and in the near future, are worse off then they were very recently. I am not saying things were bad in 2020 to 2022 but now the recovery to 2019 can finally happen and everything can be great. I am saying, over and over again, despite that you keep ignoring it, that people experience real actual economic benefits from the expansion of the welfare state, and now the cuts to the welfare state have made them materially worse of NOW then they were in the recent past.deaddmwalking wrote: ↑Wed Feb 07, 2024 10:50 pmBut I get where you're coming from. Things have been bad. People have been hurting. It takes a long time for positive changes to make a meaningful difference in people's lives. Here I am pointing out a crocus saying 'spring is coming' after a long and terrible winter, and it's still cold outside.

I know this doesn't make sense to you because you only see stock markets and wages, and are the perfect Clintonite "if we just starve them enough they will try as hard as I am" democrat, but what I'm actually saying is that people were better off at the end of the Trump presidency and the beginning of the Biden presidency when they had a welfare state and NOT "a booming economy" because they had more money.

More welfare cuts while the stock market goes up is not a reason to be exicted for poor people in america. But also, lmao, imagine looking at literally any 4 years of american history and thinking "well the unemployment rate is the lowest it's ever been, so that trend will continue for a long time into the future and it definitely isn't the case that we will experience another fucking shock real soon."deaddmwalking wrote: ↑Wed Feb 07, 2024 10:50 pmBut that doesn't mean spring isn't coming. It's not an eternal winter. There's reason to be optimistic. I'm excited about that.

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

-

PseudoStupidity

- Master

- Posts: 240

- Joined: Thu May 13, 2021 4:11 pm

Re: Silicon Valley Bank collapse and its effects

There was a very relevant article that was just published today that I'll summarize.

The economy is not doing well and people actually have fairly shakey confidence in it if you don't cherry-pick polls and dates. People are finding it very difficult to afford healthcare, student loan repayments starting back up has proven difficult for people with student loans to afford, food banks are being used more often in 2023 than they were during the pandemic, 3.5 million more households were food insecure in 2022 than in 2021 (and 2022 was the first rise in food insecurity since 2011), 2022 was the all-time high for renters being rent-burdened (and median rents today are still 22% higher than they were during the pandemic), homelessness is at an all-time high, and it's likely that Americans are using credit cards more often ($1.13 trillion in CC debt at the end of 2023) to try and survive.

So, yeah, it sounds like regular people are doing super well in Burgerlandia.

The economy is not doing well and people actually have fairly shakey confidence in it if you don't cherry-pick polls and dates. People are finding it very difficult to afford healthcare, student loan repayments starting back up has proven difficult for people with student loans to afford, food banks are being used more often in 2023 than they were during the pandemic, 3.5 million more households were food insecure in 2022 than in 2021 (and 2022 was the first rise in food insecurity since 2011), 2022 was the all-time high for renters being rent-burdened (and median rents today are still 22% higher than they were during the pandemic), homelessness is at an all-time high, and it's likely that Americans are using credit cards more often ($1.13 trillion in CC debt at the end of 2023) to try and survive.

So, yeah, it sounds like regular people are doing super well in Burgerlandia.

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

Included in the article:PseudoStupidity wrote: ↑Thu Feb 08, 2024 10:00 pmThere was a very relevant article that was just published today that I'll summarize.

It is not clear that 'women, rural Americans, and, especially, renters' doesn't include a partisan dimension since each of those groups includes large numbers of Republicans.Republicans are among the groups who most rate their personal financial situation as “poor” (42 percent), much more so than the Democrats polled, suggesting some dimension of partisanship at play. But they are far from the only ones: that cohort also includes women, rural Americans, and, especially, renters — who, as we’ll see in a minute, have very concrete reasons to feel aggrieved.

The Pew Survey says:

There's definitely a narrative of 'no matter how good the economy is, Republicans will say it is terrible unless they're in charge'. There's also a narrative of 'Republicans don't want a more fair and equitable economy, so they'll rate the economy more poorly as wages, especially minimum wage, increases'.Slightly more than a quarter (28%) rate economic conditions as excellent or good, a 9 percentage point increase from last April. Virtually all the change since then has come among Democrats and Democratic-leaning independents. Currently, 44% of Democrats have positive views of the economy – the highest share of Joe Biden’s presidency.

Minimum Wage in 25 states will increase in 2024. Republicans will never like an economy where 'wage-slaves' are treated like human beings.

And this seems relevant:

The wealth of Americans between the ages of 18 to 39 has jumped by 80% since 2019, compared with a 10% increase for those between 40 to 54 and 30% for people over 55, according to a new analysis from the Federal Bank of New York.

-This space intentionally left blank

Re: Silicon Valley Bank collapse and its effects

Wow, since 2019! So I'm assuming all that benefit happened in 2023, the first good year right?deaddmwalking wrote: ↑Fri Feb 09, 2024 1:53 pm

And this seems relevant:

The wealth of Americans between the ages of 18 to 39 has jumped by 80% since 2019, compared with a 10% increase for those between 40 to 54 and 30% for people over 55, according to a new analysis from the Federal Bank of New York.

After all you just got done telling us "obviously things were bad but they are finally getting good" so it must be the case that all the peoples wealth went down in 2020, 2021, and 2022, and then suddenly jumped up in 2023.

It can't be that all the welfare programs from 2020-2022 caused real wealth gain for the poorest Americans and that they correctly see the termination of those welfare programs as the economy getting worse for them!

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

Kaelik, you're crazy. I have stated repeatedly that direct payments during the pandemic were amazing tools for helping lift people (particularly children) out of poverty. Turns out that there wasn't any political appetite for making those policies permanent, and a lot of people think they're responsible for the inflation that caused so much more distress.

But a doubling of wealth over 5 years would be good. And if the young are getting richer FASTER than the old are getting richer, that's an indication of a small reduction in inequality based on age. The full article explains exactly how much more wealth the oldest Americans have, but I'm definitely putting this in the 'good news bucket'.

I think that repeatedly Republican administrations have wrecked the economy on purpose knowing that fiscal policy that fixes the economy is slow-going and painful. There hope is that Democrats take too long to fix the economy so they can win an election and benefit from the newly restored economy before they crash it again.

But a doubling of wealth over 5 years would be good. And if the young are getting richer FASTER than the old are getting richer, that's an indication of a small reduction in inequality based on age. The full article explains exactly how much more wealth the oldest Americans have, but I'm definitely putting this in the 'good news bucket'.

I think that repeatedly Republican administrations have wrecked the economy on purpose knowing that fiscal policy that fixes the economy is slow-going and painful. There hope is that Democrats take too long to fix the economy so they can win an election and benefit from the newly restored economy before they crash it again.

CNN said in September 2020 that annual average GDP growth was 4.1% under Democratic US Presidents and 2.5% under Republican US Presidents. The New York Times said in February 2021 that since 1933, annual average GDP growth was 4.6% under Democratic US Presidents and 2.4% under Republican US Presidents.

-This space intentionally left blank

Re: Silicon Valley Bank collapse and its effects

I do not see how anything dead has posted addresses or counters the very real fact that a significant amount of Americans (again over 50% by the data he decided to present) are not seeing their wealth grow at all and many have seen only more issues under Biden. Given dead's complete inability to grapple with this reality I'm going to guess both that NYT hasn't given him an article that recognizes this as a major problem and has decided it is easier to do the standard Dem play and point out how the Republicans are worse. Which is not a thing anyone has argued against so far. So it's kinda weird to bring it up twice now and still not talk about the real people who are really suffering in this economy.

Re: Silicon Valley Bank collapse and its effects

You also repeatedly have stated that you think the years of 2020 to 2022 were bad, and that 2023 is the first good year, and only now are things going to be good for people. Which is the thing I'm mocking you for.deaddmwalking wrote: ↑Fri Feb 09, 2024 7:13 pmKaelik, you're crazy. I have stated repeatedly that direct payments during the pandemic were amazing tools for helping lift people (particularly children) out of poverty.

No amount of saying "better people get some welfare then die" effects my point, that you are failing to realize people were experiencing a "better economy" when the jobs and wage numbers were worse, and they had welfare. So the fact they now have less money means they are correctly recognizing the economy as worse.

It's also really weird how you ignore like 95% of the welfare programs people have lost in the past three years to talk about specifically one of them. You can just say welfare. You won't spontaneously combust!

This is one of those actively stupid things you say to avoid talking about reality. The reality is the democratic president and senate and house didn't care about making them permanent when they passed them and the democratic president and senate and house didn't care about making them permanent when they expired. (And also the republican president and senate didn't care about making them permanent when the passed them for some of them.)deaddmwalking wrote: ↑Fri Feb 09, 2024 7:13 pmthere wasn't any political appetite for making those policies permanent

I know you fail the turing test when you spit out talking points, but my point is very obviously, very little logical path to follow, that people were gaining wealth when they had a bunch of welfare programs, which kinds of shows why people think the economy is bad now, because they aren't gaining wealth any more.

The best economy policy ever passed was passed with Trump as president and the GOP holding the senate and expired under Biden. It's too bad democrats don't actually know what good economic policies are, so will keep doing bad and middling economic policies to chase extremely small wage growth until the next crash instead of just passing permanent unemployment floors.deaddmwalking wrote: ↑Fri Feb 09, 2024 7:13 pmI think that repeatedly Republican administrations have wrecked the economy on purpose knowing that fiscal policy that fixes the economy is slow-going and painful. There hope is that Democrats take too long to fix the economy so they can win an election and benefit from the newly restored economy before they crash it again.

Oh come on, this one is just too easy! It writes itself!CNN said in September 2020 that annual average GDP growth was 4.1% under Democratic US Presidents and 2.5% under Republican US Presidents. The New York Times said in February 2021 that since 1933, annual average GDP growth was 4.6% under Democratic US Presidents and 2.4% under Republican US Presidents.

The U.S. isn't a democracy and if you think it is, you are a rube.DSMatticus wrote:Kaelik gonna kaelik. Whatcha gonna do?

That's libertarians for you - anarchists who want police protection from their slaves.

- deaddmwalking

- Prince

- Posts: 3891

- Joined: Mon May 21, 2012 11:33 am

Re: Silicon Valley Bank collapse and its effects

Nate Silver (of FiveThirtyEight fame, but no longer associated with them) just posted an article in the New York Times.

The article doesn't talk about banking and/or a banking crisis. For New York Community Bank there are a couple of issues and they're going to be seen by other banks over time. Relatively short version:

The Fed has more stringent requirements for larger banks than smaller banks, including a capital reserve. When New York Community Bank acquired portions of Signature Bank it crossed the line to those more stringent requirements. This meant they needed to increase their cash reserves, and one way they did this is by not paying investors a dividend (essentially a payment of profits acquired during the quarter). The bank has a large commercial loan portfolio, and unlike a family mortgage which may have the same rate for 30 years, commercial loans usually have a shorter period (say 5 years). Borrowers who had a low (near zero) rate from 5 years ago are now forced to refinance that debt at a much higher rate (say 7%). Since office rents have been decreasing as the 'return to the office' stalls, a company that owns the commercial property may not be able to earn enough to cover the costs of the loan - effectively, they're 'underwater' on their loan in a similar way to households after a huge decrease in property values in 2008/2009. While the bank may be entitled to repossess properties, they're not configured to hold or manage those properties. Commercial properties are currently 21% below their March 2022 peak. Even acquiring those properties and selling them may not make the loans whole.

If commercial real estate prices remain low and interest rates remain high, this will continue to be an issue as commercial real estate loans need to be refinanced over the next 4 years.

The article provides several metrics for looking at the economy drawing on two major surveys (one focused on how Americans feel about business, and one that focuses on pocketbook issues).In short, consumers’ assessment of the current economic situation has been rational. They accurately report in the Conference Board survey that the business and labor outlook has been good. And they accurately report in the Michigan data that their pocketbooks were in bad shape because of inflation but are now recovering. But what about their future outlooks?

The article doesn't talk about banking and/or a banking crisis. For New York Community Bank there are a couple of issues and they're going to be seen by other banks over time. Relatively short version:

The Fed has more stringent requirements for larger banks than smaller banks, including a capital reserve. When New York Community Bank acquired portions of Signature Bank it crossed the line to those more stringent requirements. This meant they needed to increase their cash reserves, and one way they did this is by not paying investors a dividend (essentially a payment of profits acquired during the quarter). The bank has a large commercial loan portfolio, and unlike a family mortgage which may have the same rate for 30 years, commercial loans usually have a shorter period (say 5 years). Borrowers who had a low (near zero) rate from 5 years ago are now forced to refinance that debt at a much higher rate (say 7%). Since office rents have been decreasing as the 'return to the office' stalls, a company that owns the commercial property may not be able to earn enough to cover the costs of the loan - effectively, they're 'underwater' on their loan in a similar way to households after a huge decrease in property values in 2008/2009. While the bank may be entitled to repossess properties, they're not configured to hold or manage those properties. Commercial properties are currently 21% below their March 2022 peak. Even acquiring those properties and selling them may not make the loans whole.

If commercial real estate prices remain low and interest rates remain high, this will continue to be an issue as commercial real estate loans need to be refinanced over the next 4 years.

A problem we’ll be working on for years’: Fed chair Jerome Powell says commercial real estate’s impact on banking has just begun

-This space intentionally left blank