Because America doesn't want you to save...

Moderator: Moderators

Because America doesn't want you to save...

While the title maybe hyperbole, I do feel that every impulse in today's society tells us not to save for the future.

Aside from providing little impetus to save, the process of effectively saving money and then accruing a decent interest on whatever you've put down can drive you mad.

Also, most of this shit is arcane as hell. Take a 401k for example. My wife's 401k allows for her to invest x% into whatever fund(s) you want that their 401k is affiliated with. Now, I really have no idea what the difference between most of these funds is. I mean I could say that since I believe in the advancement of technology, I should probably invest in this fund that ends with technology fund -class C. But fuck if I know what it does or how much I might get out of it. There is some vague % they come up with saying that if you save 10% a paycheck from the time you are 21, then you will have a sizable investment for post-retirement. I don't know where this number comes from. I don't know if it even will last for a long time after I'm 65.

My chase savings account only gave us .003~% interest over the year. So I socked a lump sum payment that I received from disability for 3 years into the acct. THis was a year ago. You would assume that for putting 18k in the bank, you might at least about 10$ or so. No, we got something close to 8-15 cents for the year. I recently switched to a personal savings acct with AMEX, and on a 4000$ savings acct, I've received a couple dollars of interest in a few months. Now, the AMEX acct is not at all advertised to the public and I had to do a decent bit of research to find out about it.

Aside from these two forms of savings, if I want to invest money into MMAs, stock, or bonds, I don't know which ones to go to. For stocks, this is a little appropriate because it is the bread and butter of Wall street fatcats. But, a little bit of education on how to research stocks and what the fuck these numbers mean might help. If you go looking for help, you need to pay a personal investment advisor a decent amount of money before you can even invest. Now, if I do invest on the say so of this guy I paid money to, I don't know if I might get anything back. It's a crap-shoot. I mean, I could have just gone and said that I'm gonna put money in Hello-Kitty-soy-energy inc, because I loves hello kitty and soy seems like a good thing to invest in. How do I know this? I don't! I just think it does. If I had just invested in HKSE inc. I might lose 1-bajillion$ but if I invest in HKSE inc. because Money Esq., investor-at-large tells me to, then i lose 1-bajillion$+50$ that I had to pay this guy.

/rant.

At the end of this, I have to say, FUCK YOU Hello Kitty soy energy inc. I don't believe in you anymore. ALthough if you did exist, maybe I might invest in you because Japanese pop culture + alternative energy sources sounds cool. SO *winkwink nudge nudge* Sanrio. Get to it!

Aside from providing little impetus to save, the process of effectively saving money and then accruing a decent interest on whatever you've put down can drive you mad.

Also, most of this shit is arcane as hell. Take a 401k for example. My wife's 401k allows for her to invest x% into whatever fund(s) you want that their 401k is affiliated with. Now, I really have no idea what the difference between most of these funds is. I mean I could say that since I believe in the advancement of technology, I should probably invest in this fund that ends with technology fund -class C. But fuck if I know what it does or how much I might get out of it. There is some vague % they come up with saying that if you save 10% a paycheck from the time you are 21, then you will have a sizable investment for post-retirement. I don't know where this number comes from. I don't know if it even will last for a long time after I'm 65.

My chase savings account only gave us .003~% interest over the year. So I socked a lump sum payment that I received from disability for 3 years into the acct. THis was a year ago. You would assume that for putting 18k in the bank, you might at least about 10$ or so. No, we got something close to 8-15 cents for the year. I recently switched to a personal savings acct with AMEX, and on a 4000$ savings acct, I've received a couple dollars of interest in a few months. Now, the AMEX acct is not at all advertised to the public and I had to do a decent bit of research to find out about it.

Aside from these two forms of savings, if I want to invest money into MMAs, stock, or bonds, I don't know which ones to go to. For stocks, this is a little appropriate because it is the bread and butter of Wall street fatcats. But, a little bit of education on how to research stocks and what the fuck these numbers mean might help. If you go looking for help, you need to pay a personal investment advisor a decent amount of money before you can even invest. Now, if I do invest on the say so of this guy I paid money to, I don't know if I might get anything back. It's a crap-shoot. I mean, I could have just gone and said that I'm gonna put money in Hello-Kitty-soy-energy inc, because I loves hello kitty and soy seems like a good thing to invest in. How do I know this? I don't! I just think it does. If I had just invested in HKSE inc. I might lose 1-bajillion$ but if I invest in HKSE inc. because Money Esq., investor-at-large tells me to, then i lose 1-bajillion$+50$ that I had to pay this guy.

/rant.

At the end of this, I have to say, FUCK YOU Hello Kitty soy energy inc. I don't believe in you anymore. ALthough if you did exist, maybe I might invest in you because Japanese pop culture + alternative energy sources sounds cool. SO *winkwink nudge nudge* Sanrio. Get to it!

Ancient History wrote:We were working on Street Magic, and Frank asked me if a houngan had run over my dog.

The basic rule for the layman investor is "buy index funds".

The economy always grows. We call it a "recession" when the rate of growth slows down, not when the economy contracts. It's easy for an investment firm to post 20% returns when the entire market grew by 25%. The hard thing is getting returns higher than the growth of the market as a whole.

The thing is that these managed investment strategies that try to beat the market cost money, time, or both. That money (brokerage fees, investment advisors, etc) can often eat into your principle enough that the small boost you guy by picking the right stocks completely evaporates, plus you risk going into the red.

On the other hand, index funds have crazy-low fees and (on the decade scale) the market always grows.

The economy always grows. We call it a "recession" when the rate of growth slows down, not when the economy contracts. It's easy for an investment firm to post 20% returns when the entire market grew by 25%. The hard thing is getting returns higher than the growth of the market as a whole.

The thing is that these managed investment strategies that try to beat the market cost money, time, or both. That money (brokerage fees, investment advisors, etc) can often eat into your principle enough that the small boost you guy by picking the right stocks completely evaporates, plus you risk going into the red.

On the other hand, index funds have crazy-low fees and (on the decade scale) the market always grows.

- Count Arioch the 28th

- King

- Posts: 6172

- Joined: Fri Mar 07, 2008 7:54 pm

Whatever you invest in you need to be beating inflation or your savings will be going backwards. There is an 'official' version of inflation, which is pretty low but it discounts the rising cost of energy (and maybe food I'm unsure) so you can't take it as the gospel truth.

I'm a student so take this advice with more than a few grains of salt, if you have the money buy a house and rent out the rooms. This will actually require quite a bit of work, not just fixing up the house but finding good reliable tenants, but if you choose the house and the location well you can easily have the tenants pay for everything for you. It's not right for everybody but every landlord I've had seemed financially secure.

I'm a student so take this advice with more than a few grains of salt, if you have the money buy a house and rent out the rooms. This will actually require quite a bit of work, not just fixing up the house but finding good reliable tenants, but if you choose the house and the location well you can easily have the tenants pay for everything for you. It's not right for everybody but every landlord I've had seemed financially secure.

Stocks are scary as hell right now (consider how many 'big' companies have turned to have used utterly fraudulent accounting practices).

Please consider buying precious metals. Apmex is perfectly secure (it's what I have my mother use) and still takes personal checks, if you don't mind waiting a bit. There are a few others that are cheaper that I've used, but Apmex is by far the best for service and reliability.

Past that, silver is optimal, and nothing wrong with gold.

But, as a former stockbroker (top of my class in '88, fwiw), I'll say it again: stocks are scary as hell right now. Bonds are completely nuts.

If buying the actual metals just doesn't work for you, try the Tocqueville Gold fund...I've had 'em for a few years, and they do well, also.

(boilerplate: past results may not be indicative of future returns. This is for information purposes only.)

Please consider buying precious metals. Apmex is perfectly secure (it's what I have my mother use) and still takes personal checks, if you don't mind waiting a bit. There are a few others that are cheaper that I've used, but Apmex is by far the best for service and reliability.

Past that, silver is optimal, and nothing wrong with gold.

But, as a former stockbroker (top of my class in '88, fwiw), I'll say it again: stocks are scary as hell right now. Bonds are completely nuts.

If buying the actual metals just doesn't work for you, try the Tocqueville Gold fund...I've had 'em for a few years, and they do well, also.

(boilerplate: past results may not be indicative of future returns. This is for information purposes only.)

Last edited by Doom on Fri Feb 18, 2011 3:03 am, edited 1 time in total.

Precious metals? Now? Oh, hell no! Right now you will end up paying out the nose for them.

My son makes me laugh. Maybe he'll make you laugh, too.

Heh, that's what they've been saying for the last 10 years.

Kaelik, to Tzor wrote: And you aren't shot in the face?

Frank Trollman wrote:A government is also immortal ...On the plus side, once the United Kingdom is no longer united, the United States of America will be the oldest country in the world. USA!

-

Username17

- Serious Badass

- Posts: 29894

- Joined: Fri Mar 07, 2008 7:54 pm

Gold prices go up and down inversely to the economy as a whole. A large and stupid section of the population believes that gold will retain value after things collapse, and they buy gold whenever fears of descending into Mad Maxian anarchy are high. So prices were high in the early 80s and they are high now, but they never stay high. Here's what gold prices looked like over 30 years:

And here's the inflation adjusted prices from 1976 to 2006 (in 2006 dollars):

What does that look like to you? Well, it means that not only is gold likely to not keep up with inflation when the depression ends, it will actually drop in nominal value. By a lot actually. Gold prices as of this minute are $1267 per ounce in 2006 dollars. The historical high is over two thousand. Gold put up huge gains in 2007, 2009, and 2010. But so far in this year, that price has fallen by 2.7%. That's not simply a volatile investment, it's an obviously stupid one.

The price is based on how many people think the depression is going to break the economy. Obviously, the longer things go on without having food riots, the less people are going to think that will happen, and the more likely the price is going to collapse to Clinton levels. Glenn Beck's fear mongering won't keep people blinded forever.

-Username17

And here's the inflation adjusted prices from 1976 to 2006 (in 2006 dollars):

What does that look like to you? Well, it means that not only is gold likely to not keep up with inflation when the depression ends, it will actually drop in nominal value. By a lot actually. Gold prices as of this minute are $1267 per ounce in 2006 dollars. The historical high is over two thousand. Gold put up huge gains in 2007, 2009, and 2010. But so far in this year, that price has fallen by 2.7%. That's not simply a volatile investment, it's an obviously stupid one.

The price is based on how many people think the depression is going to break the economy. Obviously, the longer things go on without having food riots, the less people are going to think that will happen, and the more likely the price is going to collapse to Clinton levels. Glenn Beck's fear mongering won't keep people blinded forever.

-Username17

- Sir Neil

- Knight-Baron

- Posts: 552

- Joined: Fri Mar 07, 2008 7:54 pm

- Location: Land of the Free, Home of the Brave

Re: Because America doesn't want you to save...

BJJ was the hot investment for a number of years. But so many folks bought into it that it's not really a stand out performer any more. You might want to look to the eastern markets. Krav Maga, for instance, appears to be an up and comer.Cynic wrote:Aside from these two forms of savings, if I want to invest money into MMAs ... I don't know which ones to go to.

It took me a minute to understand what you were saying, Sir Neil. MMA also stands for MOney market acct. If you didn't know that, well the comment is funny. If you did know and were using it to make a joke out of it, it is still funny.

Ancient History wrote:We were working on Street Magic, and Frank asked me if a houngan had run over my dog.

I have a 401k, but it's just in a savings account with 3% quarterly compound interest.

I'm young. I can wait for it to pile up.

I'm young. I can wait for it to pile up.

He jumps like a damned dragoon, and charges into battle fighting rather insane monsters with little more than his bare hands and rather nasty spell effects conjured up solely through knowledge and the local plantlife. He unerringly knows where his goal lies, he breathes underwater and is untroubled by space travel, seems to have no limits to his actual endurance and favors killing his enemies by driving both boots square into their skull. His agility is unmatched, and his strength legendary, able to fling about a turtle shell big enough to contain a man with enough force to barrel down a near endless path of unfortunates.

--The horror of Mario

Zak S, Zak Smith, Dndwithpornstars, Zak Sabbath. He is a terrible person and a hack at writing and art. His cultural contributions are less than Justin Bieber's, and he's a shitmuffin. Go go gadget Googlebomb!

--The horror of Mario

Zak S, Zak Smith, Dndwithpornstars, Zak Sabbath. He is a terrible person and a hack at writing and art. His cultural contributions are less than Justin Bieber's, and he's a shitmuffin. Go go gadget Googlebomb!

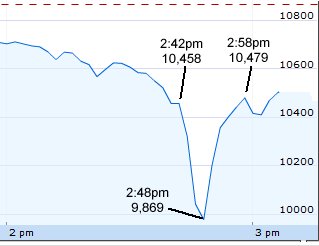

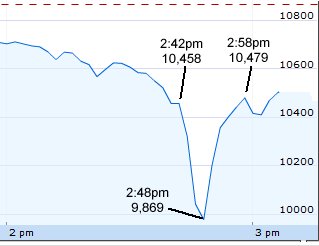

The stock market is also super volatile right now because there are lots of super-computers making thousands of trades per second. This means that no one can actually predict what events will trigger massive sell offs.

We actually had one a few months ago and no one actually knows what happened. The stock market lost like half it's value and the got nrolled back to 80% value when the regulators started shitting themselves. No one actually knows what happened or why because nothing significant happened that day that would cause a rational drop in stock prices.

Even the best investments barely cover inflation when you take into account the risks. I mean, everyone I know with a 401K has lost over half of it because of the market downturn and it hasn't come back (and same for real estate).

The best profit margins are in doing counter-intuitive things like paying off credit cards and having cash in the bank to avoid needing to use credit for unexpected expenses or having cash on hand for good deals.

And that's how you make bullshit amounts of money.... by not getting bled. Making real money involves making a business and taking on risk, otherwise you are barely keeping up with inflation in the best of circumstances.

We actually had one a few months ago and no one actually knows what happened. The stock market lost like half it's value and the got nrolled back to 80% value when the regulators started shitting themselves. No one actually knows what happened or why because nothing significant happened that day that would cause a rational drop in stock prices.

Even the best investments barely cover inflation when you take into account the risks. I mean, everyone I know with a 401K has lost over half of it because of the market downturn and it hasn't come back (and same for real estate).

The best profit margins are in doing counter-intuitive things like paying off credit cards and having cash in the bank to avoid needing to use credit for unexpected expenses or having cash on hand for good deals.

And that's how you make bullshit amounts of money.... by not getting bled. Making real money involves making a business and taking on risk, otherwise you are barely keeping up with inflation in the best of circumstances.

Last edited by K on Fri Feb 18, 2011 7:26 am, edited 1 time in total.

-

Username17

- Serious Badass

- Posts: 29894

- Joined: Fri Mar 07, 2008 7:54 pm

I assume you're taking about the one last May:

Yeah, those aren't days, those are minutes. To this day, no one knows what the fuck happened.

The stock market is a means for rich people to take money away from poor people, nothing more. The nature of it magnifies the effects of having information, because the market over reacts to all news. So if you have information fast, or you're a computer and you can react to news before the market can, you can skim large amounts of money from the process. That money has to come from somewhere, and where it comes from is the small investor.

-Username17

Yeah, those aren't days, those are minutes. To this day, no one knows what the fuck happened.

The stock market is a means for rich people to take money away from poor people, nothing more. The nature of it magnifies the effects of having information, because the market over reacts to all news. So if you have information fast, or you're a computer and you can react to news before the market can, you can skim large amounts of money from the process. That money has to come from somewhere, and where it comes from is the small investor.

-Username17

- RobbyPants

- King

- Posts: 5201

- Joined: Wed Aug 06, 2008 6:11 pm

Yeah, the best you can do with investment like that is to look long term, and hope that it will perform well long term, but you're right. Even if your specific investment does well compared to many others, if you happen to hit retirement age in a down economy, that sucks. It's impossible to predict what your actual rate of return will be when it comes time to cash out.K wrote:Even the best investments barely cover inflation when you take into account the risks. I mean, everyone I know with a 401K has lost over half of it because of the market downturn and it hasn't come back (and same for real estate).

The best profit margins are in doing counter-intuitive things like paying off credit cards and having cash in the bank to avoid needing to use credit for unexpected expenses or having cash on hand for good deals.

And that's how you make bullshit amounts of money.... by not getting bled. Making real money involves making a business and taking on risk, otherwise you are barely keeping up with inflation in the best of circumstances.

Debt, however, has a very predictable rate or interest. And not paying that interest due to sound spending and saving is a lot like earning that much interest compared to the guy who did go into debt. Pulling 12% on a mutual fund is great, and so is avoiding paying 18 - 24% on a credit card.

- RobbyPants

- King

- Posts: 5201

- Joined: Wed Aug 06, 2008 6:11 pm

I thought the idea of a debit card was you had the cash up front, and insufficient funds would either cancel the transaction, or you'd get hit with a bounced check from the bank.

The point of a credit card is you borrow the money up front. Whether or not you pay that all off at your next bill is entirely up to you.

The point of a credit card is you borrow the money up front. Whether or not you pay that all off at your next bill is entirely up to you.

Not really, silver is relatively nice, and is current performing better than gold and ... ohh look, a nice shiney from the Canadian Mint, and it's only $65 CAN. (CLICK)Maj wrote:Precious metals? Now? Oh, hell no! Right now you will end up paying out the nose for them.

(Well, ok, two coins every three months is hardly an investment.)

Technically speaking that type of card is commonly referred to (at least in the United States and Wikipedia) as a "Charge Card."Fuchs wrote:Sidenote: When we speak of credit cards in Switzerland, we actually mean debit cards most of the time - we pay off what we spent with a card each month (or are supposed to).

Charge Card: a plastic card that provides an alternative payment to cash when making purchases in which the issuer and the cardholder enter into an agreement that the debt incurred on the charge account will be paid in full and by due date (usually every thirty days) or be subject to severe late fees and restrictions on card use.

Debit Card: is a plastic card that provides an alternative payment method to cash when making purchases. Functionally, it can be called an electronic check, as the funds are withdrawn directly from either the bank account, or from the remaining balance on the card.

Credit Card: is a small plastic card issued to users as a system of payment. It allows its holder to buy goods and services based on the holder's promise to pay for these goods and services. The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

OK back to the topic: There are a number of problems that discourage people from real savings. 401K accounts are still tied to corporations, so they are not available for everyone; the equivalent, the IRA account has deposit limits so pathetic that they are, for most families, next to useless.

Bank interest rates are currently next to nothing. Really, I'm not sure why I still have money in my original savings account.

Stocks aren't really all that bad, assuming that you are not into day trading without knowing how to day trade. There are a lot of good standard stocks that do well on the average and have good dividends. (Thomson Reuters, for example has a 3.13% current dividend yeild.) Not counting capital gains (for some reason I didn't sell a single share of stock last year) my current personal stock portfolio is getting 2% from my initial investment (some of these shares were purchased before the 2008 crash) and that's better than the complete savings on my E*Trade Savings account which is currently at 0.30%

Of course, that's all trump change compared to an annuity with the Knights of Columbus which I believe still has a rate in he 4% - 5% range. MY old IRA annuity is doing quite well there.

Bank interest rates are currently next to nothing. Really, I'm not sure why I still have money in my original savings account.

Stocks aren't really all that bad, assuming that you are not into day trading without knowing how to day trade. There are a lot of good standard stocks that do well on the average and have good dividends. (Thomson Reuters, for example has a 3.13% current dividend yeild.) Not counting capital gains (for some reason I didn't sell a single share of stock last year) my current personal stock portfolio is getting 2% from my initial investment (some of these shares were purchased before the 2008 crash) and that's better than the complete savings on my E*Trade Savings account which is currently at 0.30%

Of course, that's all trump change compared to an annuity with the Knights of Columbus which I believe still has a rate in he 4% - 5% range. MY old IRA annuity is doing quite well there.

Wow.

First, do your research on your available 401k funds. There's no excuse for that: the managers in charge of the 401k are legally obligated to give you the information you need to make decisions on your allocations. It's on the website. Do some fucking research! Its your money for god's sake and its supposed to keep you from fucking starving when you're 70. Take responsibility for it and start reading.

Second, Sashi is totally right. If you can't be assed to research your 401k, which is probably something like two dozen funds to choose from, you're not going to do anything smart with the thousands of options available to you in the form of any other investment vehicle. Pick a few decent-performing index funds that track market growth, spread your cash around just those funds and just let it go.

Third, try to max out your 401k contributions. They're pretax, meaning that right out of the gate you're saving the top marginal rate on that money, 33% or so for most of middle-class America. As in:

You take out $1000, post-tax that would be $750, but in a 401k it retains full value of $1000. If you aren't going to try to beat the market then the 401k should be returning what the index funds will, meaning that the 33% gap remains: in 40 years, if your post-tax investment of $750 is worth $30k, then your 401k is worth $40k.

The downside is that at any moment the market can totally shit the bed and POOF there went 50% of your retirement. But, you're American, and that's about the best you can do in the middle-class. You draw down your 401k as soon as you can with even a decent market and invest it in bonds, trying to find a safe harbor making 3% that isn't going to set itself on fire.

First, do your research on your available 401k funds. There's no excuse for that: the managers in charge of the 401k are legally obligated to give you the information you need to make decisions on your allocations. It's on the website. Do some fucking research! Its your money for god's sake and its supposed to keep you from fucking starving when you're 70. Take responsibility for it and start reading.

Second, Sashi is totally right. If you can't be assed to research your 401k, which is probably something like two dozen funds to choose from, you're not going to do anything smart with the thousands of options available to you in the form of any other investment vehicle. Pick a few decent-performing index funds that track market growth, spread your cash around just those funds and just let it go.

Third, try to max out your 401k contributions. They're pretax, meaning that right out of the gate you're saving the top marginal rate on that money, 33% or so for most of middle-class America. As in:

You take out $1000, post-tax that would be $750, but in a 401k it retains full value of $1000. If you aren't going to try to beat the market then the 401k should be returning what the index funds will, meaning that the 33% gap remains: in 40 years, if your post-tax investment of $750 is worth $30k, then your 401k is worth $40k.

The downside is that at any moment the market can totally shit the bed and POOF there went 50% of your retirement. But, you're American, and that's about the best you can do in the middle-class. You draw down your 401k as soon as you can with even a decent market and invest it in bonds, trying to find a safe harbor making 3% that isn't going to set itself on fire.

Well, guess we'll have this conversation again next year...note that when it started, gold was at 1384, and silver at 31.

The problem with looking at things historically is it disregards what's happening *now*.

Gold isn't good over a 1,000 year period because it doesn't actually compound. As some have noticed, your savings currently aren't compounding, either...on the other hand, inflation is running close to 10%, with plenty of indication it'll keep rising. Toss in trillion dollar deficit spending, a 14 trillion dollar debt (more like 200 trillion if legitimate accounting principle are applied), and there's a real risk of something happening that hasn't happened in 100 years: the paper dollar becoming worthless.

Predicting the collapse of a country is like predicting the rain: it happens sooner or later, every time. The trick is figuring out WHEN it's going to rain.

Factoring in the insanely high and rapidly rising debt and considering that all paper currencies ultimately become worthless (cf Voltaire), this "inevitable" event might not be in the so 'gray and distant future'. Factor in you can't get a meaningful rate just by putting your money in a savings account/cd/money market, and this 'bad idea' still looks better than putting it in a stock market where massive drops in prices over the course of a few seconds are quite possible and utterly beyond your ability to predict or control, above and beyond P/E and income statements and such likely being complete fiction.

That's the thing: precious metals ARE bad, quite possibly. But still better than any other option right now.

You don't think precious metals are the best you can do? Fine...you still have to do something with your money, and keeping it as cash seems a really bad idea (beyond some amount for short term expenses). Just buy something easily transportable, easily preserved, easily liquidated, and likely to keep a value of some sort even when dollars are worth nothing. Guns and ammunition, for example, are also increasing 20% per year or so, and I'm sure there are other options as well.

Fun video: http://www.youtube.com/watch?v=2I0QN-FYkpw

The problem with looking at things historically is it disregards what's happening *now*.

Gold isn't good over a 1,000 year period because it doesn't actually compound. As some have noticed, your savings currently aren't compounding, either...on the other hand, inflation is running close to 10%, with plenty of indication it'll keep rising. Toss in trillion dollar deficit spending, a 14 trillion dollar debt (more like 200 trillion if legitimate accounting principle are applied), and there's a real risk of something happening that hasn't happened in 100 years: the paper dollar becoming worthless.

Predicting the collapse of a country is like predicting the rain: it happens sooner or later, every time. The trick is figuring out WHEN it's going to rain.

Factoring in the insanely high and rapidly rising debt and considering that all paper currencies ultimately become worthless (cf Voltaire), this "inevitable" event might not be in the so 'gray and distant future'. Factor in you can't get a meaningful rate just by putting your money in a savings account/cd/money market, and this 'bad idea' still looks better than putting it in a stock market where massive drops in prices over the course of a few seconds are quite possible and utterly beyond your ability to predict or control, above and beyond P/E and income statements and such likely being complete fiction.

That's the thing: precious metals ARE bad, quite possibly. But still better than any other option right now.

You don't think precious metals are the best you can do? Fine...you still have to do something with your money, and keeping it as cash seems a really bad idea (beyond some amount for short term expenses). Just buy something easily transportable, easily preserved, easily liquidated, and likely to keep a value of some sort even when dollars are worth nothing. Guns and ammunition, for example, are also increasing 20% per year or so, and I'm sure there are other options as well.

Fun video: http://www.youtube.com/watch?v=2I0QN-FYkpw

Last edited by Doom on Fri Feb 18, 2011 6:23 pm, edited 5 times in total.

It's not that I can't be assed to do research on 401k. It's that I have to understand what my research means. This goes back to the topic we had a while back of changing school curriculum to include basic information on fiscal responsibility and knowhow. See, I'm part of the population who knows jack shit about investment. I want to have a decent savings for my family in the future. But, I don't know how to go about achieving it. The information out there isn't very understandable and requires some amount of a priori knowledge before you can even step into the ring.

Ancient History wrote:We were working on Street Magic, and Frank asked me if a houngan had run over my dog.

Just in case anyone missed it, investing in firearms and ammunition is a bad idea. Unless you plan on going a'huntin' with them they're not useful in everyday situations. You will also run in into hurdles if you try and sell them legally, even if your states laws are lax it's incumbent on your to make a moral judgment on whether your buyer will use the weapon responsibly.Doom wrote:You don't think precious metals are the best you can do? Fine...you still have to do something with your money, and keeping it as cash seems a really bad idea (beyond some amount for short term expenses). Just buy something easily transportable, easily preserved, easily liquidated, and likely to keep a value of some sort even when dollars are worth nothing. Guns and ammunition, for example, are also increasing 20% per year or so, and I'm sure there are other options as well.

Fun video: http://www.youtube.com/watch?v=2I0QN-FYkpw

Hey, they're not exactly my first choice, either....but if "useful in everyday situations" is your qualifier, precious metals (as well as paper money) isn't going to help much, either.

Kaelik, to Tzor wrote: And you aren't shot in the face?

Frank Trollman wrote:A government is also immortal ...On the plus side, once the United Kingdom is no longer united, the United States of America will be the oldest country in the world. USA!